Culture & Wellness

Council Members are:

- Ambassadors for the organization

- Champions of inclusion

- Models of our core values

- Respected among their peers with a significant sphere of influence

- Making a visible commitment to inclusivity

- Creating collaborative opportunities and leaning into different perspectives

- Leveraging talents, skills and knowledge of the council to foster change

- Open to new ideas and ways of thinking

- Creators of an environment where others can safely voice different opinions

As part of this vision, we strive to foster a culture and workplace:

- That is inclusive and welcoming

- Where all Teammates feel respected, embrace differences and care about each other

- That promotes diversity of thoughts, ideas, perspectives and values

- That is equitable, where all Teammates are treated fairly, and have access to opportunity and advancement

- That is committed to hiring the best qualified talent and promoting people on their merits

- That provides all Teammates with the resources and training to promote an inclusive work environment

- That provides fair and equal employment opportunity and career development practices and policies

Through our activities, we:

- Recommend inclusive celebratory observances for the organization

- Curate and author enterprise-wide communication and discussions

- Host and facilitate inclusive meetings and webinars to address emerging topics

- Support Employee Resource Groups as they grow and act as a liaison for internal and external stakeholders

- Recommend and champion strategic objectives to support the overall business strategy

As of December 2024

Employee Total

2,125 Full-time Teammates

Workplace Wellness

myWellbeing

We elevate our wellness program through myWellbeing. The myWellbeing Program, powered by Personify Health, offers fun challenges, helpful content, engaging social options and tools to encourage making wellness a priority for all.

Teammates have an opportunity to earn points by taking charge of their health by watching health and wellness videos, staying on track with annual preventive checkups, participating in financial wellness tasks and community service activities, tracking/maintaining good sleep habits, motivating other Teammates and through many other types of wellbeing activities. Activities include both corporate- and participant-sponsored healthy habit challenges, step challenges and journeys. Corporate-sponsored step challenges allow participants to convert their daily activities into steps should Teammates have mobility issues. In 2024, Teammates logged enough steps to walk around the earth 5.5 times!

The points earned are converted to Rewards Cash that can be redeemed for major retailer gift cards or merchandise in the Personify Health store. In 2024, $769,100 in rewards were paid out through Personify Health.

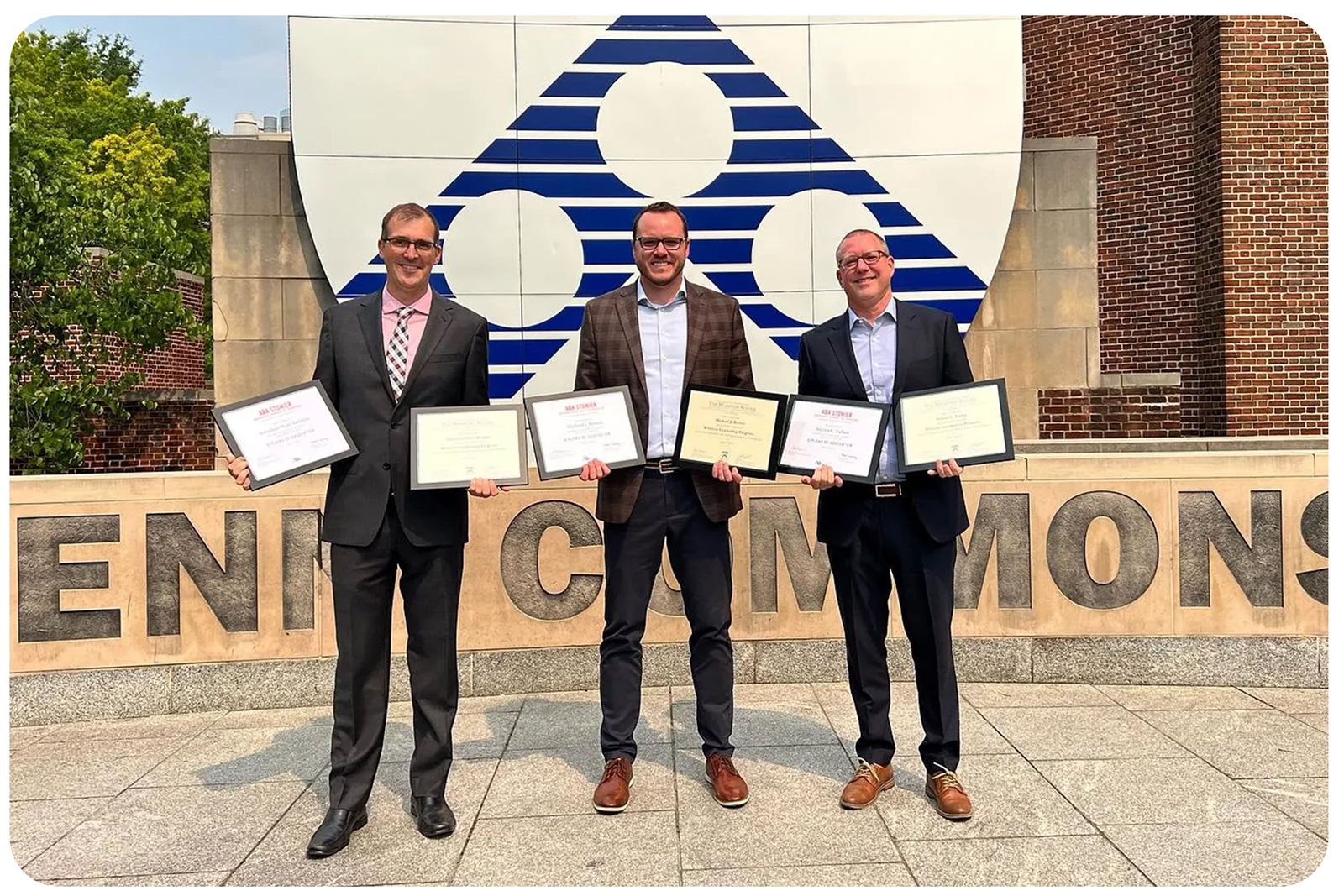

Council of Teammates

Council of Teammates Teammate Experience Advocates

Teammate Experience Advocates