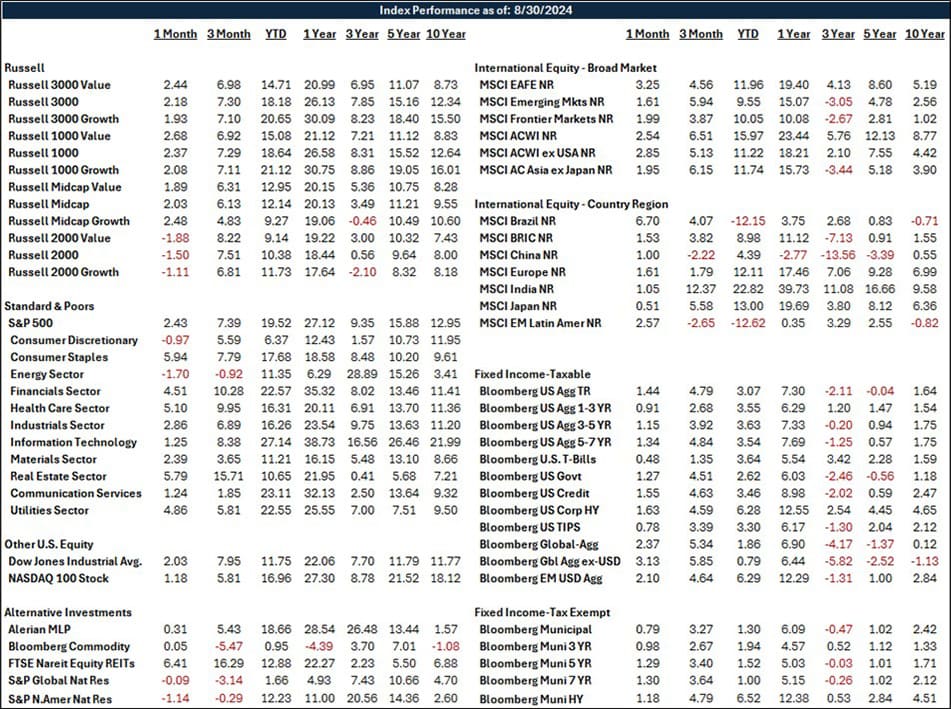

Recap: Economic growth defied expectations in the second quarter. The U.S. economy accelerated in the second quarter as consumers increased spending, businesses invested more in equipment and stocked inventories, and inflation cooled. Real GDP expanded at a 3.0% annualized rate, a sizable acceleration from 1.4% in Q1. Such a strong upturn could be head-scratching when stacked against the various and broader signs of economic deceleration reported over the past few months. However, the underlying details revealed familiar signs of waning momentum.

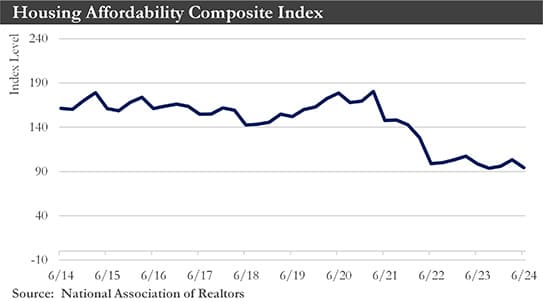

No matter how resilient the broader economy has appeared, cracks have materialized across interest-rate-sensitive sectors. The housing market has been caught in the crossfire. Both new and existing home sales softened in June. Elevated rate expectations and election uncertainty have discouraged would-be buyers. As inventories have climbed higher at a slower sales pace, weak demand has become a greater burden on the resale market than low supply. Existing home prices rose in June, apparently keeping buyers caught between increasing prices and elevated mortgage rates. Demand for new construction has also been losing steam. Plentiful new home inventories have discouraged development.

The manufacturing sector has continued to struggle in a weak demand environment. Durable goods orders plunged in the last two months. It could indicate the broader flatlining in manufacturing activity that has emerged against higher financing costs. The uncertainty around the election and its implications for interest deductibility and capital investment expensing will likely limit the scope for a manufacturing rebound heading into November.

Growth in real disposable income has not kept pace with growth in real consumer spending. Consequently, some households have resorted to unsustainable means to maintain current spending levels. The value of household checking and savings deposits has fallen, credit card debt has risen, and the personal savings rate has become depressed.

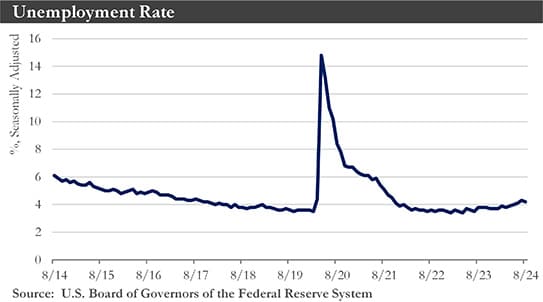

Deceleration in economic activity has been associated with some softening in the labor market. Payroll growth has slowed recently, and the unemployment rate has trended higher. Consequently, wage growth has moderated. A welcome byproduct of slower economic growth and a softening labor market has been less upward pressure on consumer prices (inflation).

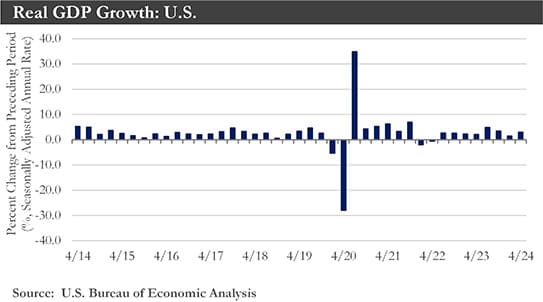

Inflation: Price pressures remained relatively subdued in July. The Consumer Price Index (CPI) rose 0.2% in July from June. On a twelve-month basis, CPI fell to 2.9% (from 3.0% in June). Core CPI prices rose 0.2% in July. The twelve-month change of Core CPI slipped by a tenth of a percentage point to 3.2% – the slowest pace of growth in over three years. Nearly all of last month's CPI gain has been attributed to higher shelter costs, which carry a much smaller weight in Core PCE inflation. Moreover, goods prices continued to edge lower.

Inflation should subside further in the months ahead as upward pressure on prices continues to slow. The softer jobs market has dampened growth in labor costs for goods and services providers. In the meantime, more tepid consumer demand has made it more difficult for businesses to raise prices without hurting sales.

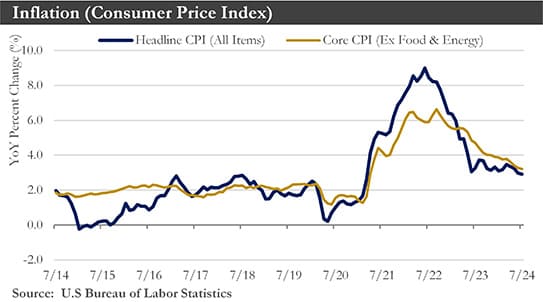

Housing: The adverse impacts of higher mortgage rates and increased home prices have continued reverberating across the housing market. High interest rates have suppressed demand in the housing sector. Mortgage rates rose recently as sticky inflation in the first quarter prompted a rise in rate expectations. Homebuying broadly retreated in response, giving way to new and existing home sales declines.

The new home market has softened recently alongside higher mortgage rates, increased availability of existing homes, and moderate pacing of economic growth. These factors will likely remain constraints moving forward.

A full-fledged rebound in home sales is still improbable, given that affordability conditions have remained unfavorable due to strong underlying demand, scarce supply, and a less robust macroeconomic environment. The expected rate-cutting cycle later this year should help mortgage rates fall further. While lower rates should help improve affordability conditions for buyers and make pricing incentives less of an imperative for home builders, a deteriorating macroeconomic backdrop marked by higher unemployment and slower income growth could continue as headwinds for the housing market.

Labor Market: America has continued to add jobs, but the labor market’s strength has been fading. Non-farm employment rose by only 114,000 in July. The unemployment rate rose by 0.2 percentage points to 4.3%. Meanwhile, the labor force participation rate edged higher to 62.7%. Average hourly earnings rose by a modest 0.2% in July from June.

The July employment report came in on the softer side. This was consistent with other labor metrics, including quit and hire rates and the ratio of job openings to the unemployed, which have been at or below pre-pandemic levels. Given the softening in labor market fundamentals, a September rate cut is almost a guaranteed. The labor market has not added to inflationary pressures, and waiting much longer could risk pushing recent normalization dynamics too far in the other direction.

Monetary Policy: With clearer signs of softness in U.S. economic data and somewhat unsettled financial market conditions, there is a debate on the need to front load rate cuts. While it is possible the Fed could lower its policy rate by 50 bps at the September and November meeting, the more plausible outcome is consecutive 25 bps cuts for the foreseeable future.

While the developing economic environment may call for a faster pace of Fed rate cuts than expected just a few months ago, the exact timing and magnitude of those rate moves will still be dependent to some extent on how long the recent market stresses persist or whether financial markets could retain a sense of relative market calm.

U.S. Dollar: With the Fed likely to respond to economic conditions with more aggressive easing, the outlook for the strength of the U.S. dollar has changed. In the short term, uncertainty over global economic conditions, the financial markets, the U.S. election, and the path of Fed monetary policy could keep the dollar supported only through year-end before some weakness in early 2025. However, assuming that the Fed cuts rates 50 bps in September and November and slows the pace of easing in 2025, the dollar could recover some ground in the second half of next year.

The Global Economy: The transition from economic divergence to greater economic convergence continues. In the United States, signs of economic slowdown have become apparent, while China's economy has slowed after a solid start to the year. Meanwhile, despite temporary and election-related uncertainties, the Eurozone and the United Kingdom have remained on an overall modest economic upswing. In addition to economic convergence, restrictive monetary policy has contributed to a gradual slowdown in global growth. After global GDP growth of 3.3% in 2023, global growth of only 3.0% should occur as 2024 ends.

Eurozone: Economic growth in the Eurozone should strengthen gradually over time. To be sure, recent economic news has been mixed. In the Eurozone, the manufacturing and service sector Purchasing Manager’s index (PMI) fell in June, though concerns surrounding the recent French elections were likely a contributing factor. Against that backdrop, the case for a European economic mild recovery has remained intact, with the strengthening trend in Eurozone real household incomes likely supporting consumer spending. In addition to firming Eurozone growth prospects, lingering inflation concerns have persisted, as services inflation remained at 4.1% in June. Against this backdrop, the European Central Bank (ECB) held its Deposit Rate at 3.75% at its July meeting. The ECB showed little inclination to entirely commit to a September rate cut ahead of time.

Considering recent growth and inflation figures, a gradual pace of ECB monetary easing is expected in the coming months. If wage and price pressures remain sticky, two more rate cuts will likely happen this year, in September and December. However, later or even more gradual ECB easing could occur.

China: China's central bank continued a wave of monetary easing to support the country's ailing economy. The People's Bank of China lowered the rate on its one-year medium-term lending facility the first such cut it has made since August 2023. It also injected substantial liquidity into the market.

China’s banking sector has been grappling with shrinking profit margins amid tepid borrowing appetite from households and corporations. Households’ reluctance to spend has resulted in built-up savings that have driven up lenders’ liability costs, while bad loans from the beleaguered property sector have posed another drag. However, analysts say fiscal stimulus would likely need to do most of the heavy lifting in China's recovery effort, given the constraints posed by yuan weakness and banks' falling profitability.

Outlook: The U.S. economy has been decelerating recently, and labor market conditions have softened. Real GDP should grow at a below-average pace in the next few quarters. A welcome byproduct of slower economic growth and a softening labor market has been less upward pressure on consumer prices. If payroll growth downshifts further in the coming months and inflation continues to recede, then the FOMC would be very likely cut its target range for the federal funds rate at the September policy meeting.

The economic growth divergence between the U.S. and G10 economies that was apparent early this year appears to be turning to convergence. There have been tentative signs of an approaching U.S. economic slowdown, while European economies have remained on an overall gradual upswing. There would also likely be a convergence on the inflation and interest rate fronts.

Converging growth trends have paired with a global economic outlook that has softened and become modestly more uncertain. Election outcomes across many emerging economies, as well as in France and the United Kingdom, have injected temporary uncertainty; however, a fair degree of policy continuity should be expected. Moderate deviations from previous policy paths would result in minimal prolonged economic or market impact.

With the Fed maintaining elevated interest rates for now, the U.S. dollar will likely stay strong over the next several months, although more gradual easing from international central banks could limit foreign currency declines. Once the Fed has begun easing, depreciation pressures would likely build on the dollar producing a downtrend in the dollar which could persist for at least the first half of 2025.

Sources: Department of Labor, Department of Commerce, National Association of Realtors, Institute for Supply Management, People’s Bank of China, Eurostat