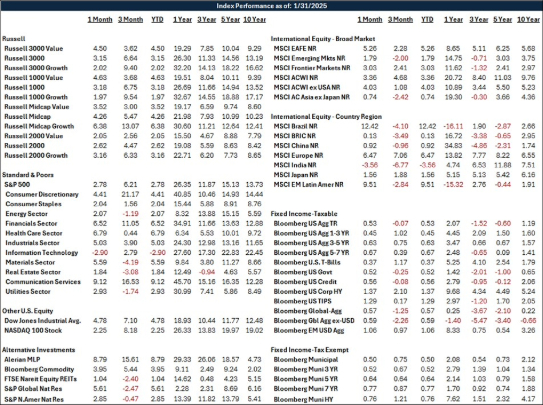

Recap: Recent data has continued to demonstrate the U.S. economy's resilience. Holiday sales closed out 2024 stronger than expected, small business optimism rallied back to pre-pandemic levels, and home builders signaled greater confidence in the traffic of prospective buyers. The steady demand impulse has kept some inflation pressure. The Consumer Price Index ended the year at 2.9% year-over-year, which was a minor improvement from its 3.1% rate in January 2024 and has pointed to stalled progress on the road back to the Federal Reserve's 2% inflation target.

Meantime, the risks surrounding the maximum employment side of the Fed’s mandate have subsided. Initial claims for unemployment insurance have remained historically low. Nonfarm payroll growth surprised to the upside in December, and the unemployment rate unexpectedly fell to 4.1%. The net share of small businesses planning to hire in the next three months rose to 19% in December, the highest reading in nearly two years. Given the recent string of solid jobs data, the Fed should feel comfortable maintaining a more restrictive stance on monetary policy this year. Only two 25 bps rate cuts should occur this year and in the second half of 2025. The Fed would hold the Fed funds rate at a target range of 3.75%-4.00% through 2026.

The labor market's stabilization has supported wage growth, which has underpinned robust consumer spending. Retail sales rose 0.4% in December, following upward revisions to the prior month's gain. Holiday sales rose 4.1% in 2024. The 2024 holiday shopping season beat expectations and was stronger than 2023. As long as consumers have remained employed and earn income, they should continue to spend.

The third estimate of real GDP showed output expanding at a 3.1% annualized rate in Q3, up from an initially reported 2.8%. The upward revision stemmed from stronger growth in consumer spending and exports. Real final sales to private domestic purchasers ticked up to 3.1% year-over-year, running ahead of its 2.9% average annual growth over the 2010-2019 economic expansion. In short, final demand has been solid.

The Trump Administration: There has been much uncertainty around what policy proposals from President Donald Trump’s campaign trail would be prioritized and if/when they would ultimately be implemented. At this point, an extension of the 2017 Tax Cuts & Jobs Act (TCJA) could occur, including many clauses set to sunset at the end of 2025.

There could also be an expansion of tax cuts and a levying of new tariffs. The size and scope of these policy initiatives have remained uncertain and up for debate. However, Trump has proposed a 10% across-the-board tariff on all imports and a 60% tariff on Chinese imports. The Administration has recently changed these numbers and even put pauses in place to enact them. In short, new tax cuts lead to stronger GDP growth and higher inflation. At the same time, the proposed tariffs could impart a modest stagflationary shock to the U.S. economy, thus offsetting some of the boost from tax cuts.

Inflation: On a monthly basis, the headline CPI rose 0.4% in December on the wings of higher gasoline and food prices. Excluding food and energy, the core CPI rose a tamer 0.2%. The CPI details and December's Producer Price Index suggested the core PCE deflator rose 0.2% in the final month of 2024. If realized, that increase would leave the year-over-year change at 2.8%, down three-tenths from where it started the year. With the Federal Reserve's preferred gauge of inflation also showing stalled progress and considering the potential inflationary impulse of policy changes from the incoming Administration, the risks to the Fed’s price stability mandate have risen in recent months.

Labor Market: The U.S. economy added 256,000 jobs last month, and the unemployment rate has edged down to 4.1%. The results showed that the U.S. labor market has recovered from its midyear stumble and may even be gaining steam. Average hourly earnings rose 3.9% from December 2023. Hiring was driven by the same sectors that have powered the labor market all year—healthcare, social assistance, government, and leisure and hospitality.

The U.S. added more than 2 million jobs in 2024. The unemployment rate has moved close to a level that Federal Reserve officials believe should be sustainable over the long run. After rising in the first half of 2024, it appears to have stabilized since the summer, easing concerns that arose in the fall about potential deterioration.

In contrast to a year ago, the labor market is no longer seen as so strong that it could jeopardize the Fed's goal of wrestling inflation back down to 2%.

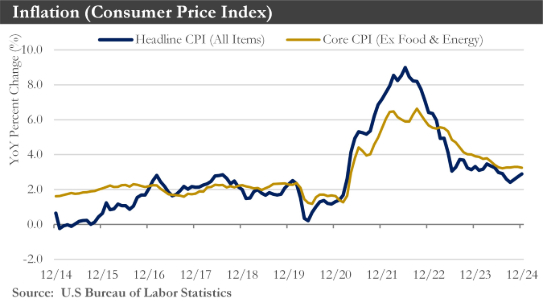

Manufacturing and Services: The ISM Manufacturing Index was in contraction for the past nine straight months and for 25 of the past 26 until January. January’s reading showed broad-based strength in four of the five components that made up the index. This would mark the fifth straight month of improvement in the index, suggesting more of a trend than a one-off bump.

After a slowing in service sector activity in November, the ISM Services Index signaled a snapback in December, with three out of the four components that fed into the headline index rising and all four remaining in expansion territory. Fifteen of eighteen industries have reported higher prices, while no industry reported a price decline. This increase has signaled the current conundrum for the Fed: the stickiness in price pressure that comes from still-solid services activity. To the extent this translates to firmer services’ inflation, it could complicate the trajectory for lower rates this year.

Monetary Policy: A gradual drawdown of the federal funds rate to a target range of 3.00%-3.25% should transpire by the end of 2025. But to the extent that the incoming Trump administration's tariff and income tax policies raise inflation, it could cause a slower reduction in interest rates, potentially closer to bottoming around only 4% next year. That said, the Fed would likely wait until policies have become more fully formed and their effects better understood before acting.

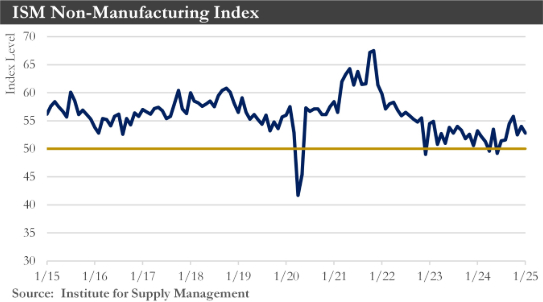

U.S. Dollar: With Trump beginning his second term, a strong dollar should arise over the course of 2025. The U.S. dollar has entered the new year on a high—and most signs have pointed to more strength ahead. The currency has been a key beneficiary of U.S. exceptionalism. The American economy has grown faster than most, with Europe stuck in a manufacturing rut and China struggling to contain the fallout from its property meltdown.

The Federal Reserve’s hesitance to cut interest rates has increased the appeal of holding dollars. At the same time, the artificial intelligence euphoria that has lifted U.S. stocks has continued to draw in foreign investors. Key drivers this year would be Trump's policies and their impact on inflation and the Federal Reserve's stance on interest rates.

The Eurozone Economy: The Eurozone economy has entered 2025 on an unsteady and uncertain footing. While household fundamentals have been favorable overall, they could become less supportive as 2025 progresses, suggesting the pace of consumer spending could slow. The outlook for the corporate sector has remained challenging, and a further decline in investment spending would not be ruled out.

In addition to mixed fundamentals, sentiment has slipped through the latter part of 2024. Political uncertainties in France and Germany and concerns surrounding the threat of U.S. tariffs on imports from Europe have been factors that have weighed on sentiment. Given the mixed fundamental backdrop and softening sentiment, Eurozone GDP should grow by no more than 1.0% in 2025. However, considering the prevailing uncertainties, there would be downside risks to even this modest outlook.

The European Central Bank (ECB) should continue steadily along its monetary easing path through much of 2025. Rate cuts of 25 bps would be expected at the March, April, and June meetings, with a final 25 bps rate cut in September for a terminal ECB policy rate of 1.75%. The growing wedge between the European Central Bank and Federal Reserve policy interest rates should keep the euro on the defensive versus the US—dollar over the medium term.

China: China’s economy grew 5 percent in 2024, as surging exports and strong investment in factories and industrial equipment mostly offset a lingering slump in construction. The real engine of the economy would now lie in an ever-widening trade surplus, which reached almost $1 trillion last year.

Exports were strong partly because China’s vast population has been unable to afford many of the goods churned out by the country's factories. The middle class has lost much of its savings due to a plunge in the value of homes, by far the main asset of most households. The result has been weak consumer spending that has only now started to bottom out. Corporate profits have been eroding for the past three years.

In recent months, the Chinese government has pursued several strategies to stabilize the economy. Government workers have been given raises, and local governments have been allowed to issue more bonds. The national government has encouraged building roads and other infrastructure projects to address the loss of construction jobs for real estate developers. The government has pursued an extensive so-called cash-for-clunkers program to reignite consumer spending.

This year should prove to be another challenging year for China's economy. Higher U.S. tariffs on imports from China could weigh on China's export sector, a key growth driver during the latter part of last year. In addition, unless or until the government announces a large-scale fiscal stimulus to support the consumer sector, retail and services activity will likely keep growing at its current pace. Against this backdrop, China's GDP growth will slow this year from the 5% pace seen in 2024.

Outlook: Full-year U.S. economic growth in 2025 should be around 2.7%. This estimate underscores a potent formula that has powered the U.S. economy through a turbulent global backdrop: a stretch of strong productivity growth, a labor market that has softened but stayed resilient, and a largely effective policy response from the Federal Reserve to rising prices.

However, there has been some uncertainty about this outlook. The potential for higher tariffs and large-scale deportations could pose notable downside risks. However, that would be weighed against the potential for further tax cuts and a lighter touch on regulation, which could lift animal spirits and offset growth.

U.S. GDP expanded by about 2.8% in 2024, after rising by 2.9% a year earlier. That vastly outpaced the eurozone, which likely recorded a 0.8% growth rate last year. The divergence has come as U.S. inflation has fallen from a peak 12-month rate of around 9% in 2022 to less than 3% by the end of last year.

Outside the U.S., the West’s major economies have faced many challenges. In Europe, countries such as France and Germany have experienced an energy crisis that followed the outbreak of war in Ukraine, and manufacturers, especially in the car industry, have contended with an influx of Chinese imports. Businesses in the U.K. have been girding for higher taxes as financial markets pressure the government to discipline its spending.

In addition to regional setbacks, these economies have been largely passed over by notable U.S. labor productivity growth, a trend promoting low-inflation growth.

The evidence of structural divergence between the U.S. and Europe could push the U.S. even further ahead. Over time, this would translate into higher returns on U.S. investments, increased inbound capital flows from abroad, a stronger dollar, and U.S. living standards pulling away from those of other advanced economies.

Sources: Department of Labor, Department of Commerce, Federal Reserve, Bloomberg, European Commission, Peoples Bank of China, Institute for Supply Managemen