Round Up Savings

The digital change jar to help you grow your savings!

With Round Up, you don’t have to think about adding to your savings account.

Let your checking account automatically do the work for you.

Enroll

Spend

Save

With Round Up Savings, every transaction you make with your debit card will be rounded up to the nearest dollar – and then the extra money will be deposited straight into an Atlantic Union Bank savings account of your choice.

- An easy way to save

- Money goes straight from your checking to your savings account

- Unlimited Round Up transfers

You’ll be surprised at how quickly the Round Up can add up.

It’s a no-stress way to contribute to your savings account.

Come in to a branch to enroll in Round Up Savings today. You can also schedule an appointment.

FAQs

Round Up Savings is an automated and simple way to grow your savings every time you make a debit card purchase.

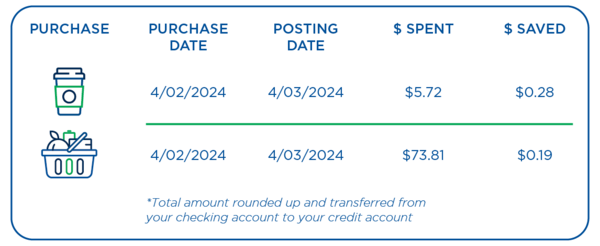

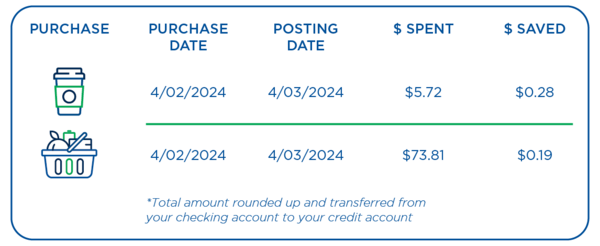

Each debit card transaction is rounded up to the nearest whole-dollar; at the end of every processing day each “posted” debit card transaction round up amount is aggregated and transferred to your designated credit account. For example:

Round Up Savings allows you to electronically save your spare change. It’s an easy way to build your savings without thinking about it.

No, there are no fees associated with Round Up Savings.

No. Round Up Savings is not a separate type of savings account or product. Essentially, it’s a feature or service we make available to all consumers.

Any consumer who has an Atlantic Union Bank consumer checking account, debit card, and any other consumer checking, money market or savings account for the transfers to be deposited into. Health Savings Accounts and Business accounts are not eligible products for Round Up Savings.

No. Both the debit and credit account has to be an Atlantic Union Bank account.

No, you can designate any of your Atlantic Union Bank checking, money market or savings accounts as the credit account.

No, only one credit account can be linked to your checking account.

Consumers who have their Personal Savings account linked as the credit account will have their minimum balance requirement waived each month a Round Up Savings Transfer is credited to their account. This is a great way to establish a savings account and avoid being charged for not meeting the minimum balance requirement.

No. A Round Up Savings transfer into a money market or other checking account will not help you avoid a monthly maintenance fee if your account has a minimum balance requirement. This benefit is only available on our Personal Savings account.

You must be an account owner on each debit and credit account to establish Round Up Savings. You cannot have a Round Up Savings transfer deposited into an account that you are not an owner of.

If you have more than one debit card linked to your checking account, all debit card transactions for each card will be rounded up to the nearest whole-dollar and transferred your designated credit account.

The Round Up Savings transfer will occur the next business day after your debit card transaction(s) “posts” to your account. Pending transactions must post to your account before being rounded up and transferred.

Since the round up transfer is posted on the next business day, other transactions could post that would cause your balance to be less than the round up transfer amount. If that occurs, the round up transfer could overdraw your account; however, you will not be assessed an overdraft fee for the round up transfer transaction.

No. If a merchant processes a refund to your debit card, previous Round Up Transfers will not be impacted.

Visit any Atlantic Union Bank branch or call Customer Care at 800.990.4828 to enroll. Our bankers will complete an enrollment form and ask for your signature to authorize us to enroll your accounts.

Absolutely. You can enroll or un-enroll at any time. Simply visit one of our branches or call Customer Care.

Better Customer Support Starts here

Not sure where to start? We can guide you in the right direction.