You’ve been pre-qualified* for a Home Equity Line of Credit

Open a variable rate HELOC of between $50,000 and $150,000 at our new Woodbridge branch, and get Prime for Life!*

For lines over $150,000, you'll get a variable rate as low as Prime minus 0.50%.*

Smart money management tool

You invest so much time and money into your home – it’s time to make it work for you.

- No closing costs – Closing costs reimbursed for lines up to $400,000; $600 credit for larger lines1

- Only pay interest on the funds you use

- Flexible repayment options

- Fast turnaround time from application to closing with most loans closing in about 30 days2

- Access to funds over a 15-year draw period

To take advantage of this offer when you apply online, you’ll need to close your loan at the new Woodbridge branch before this opportunity ends on June 30, 2025.

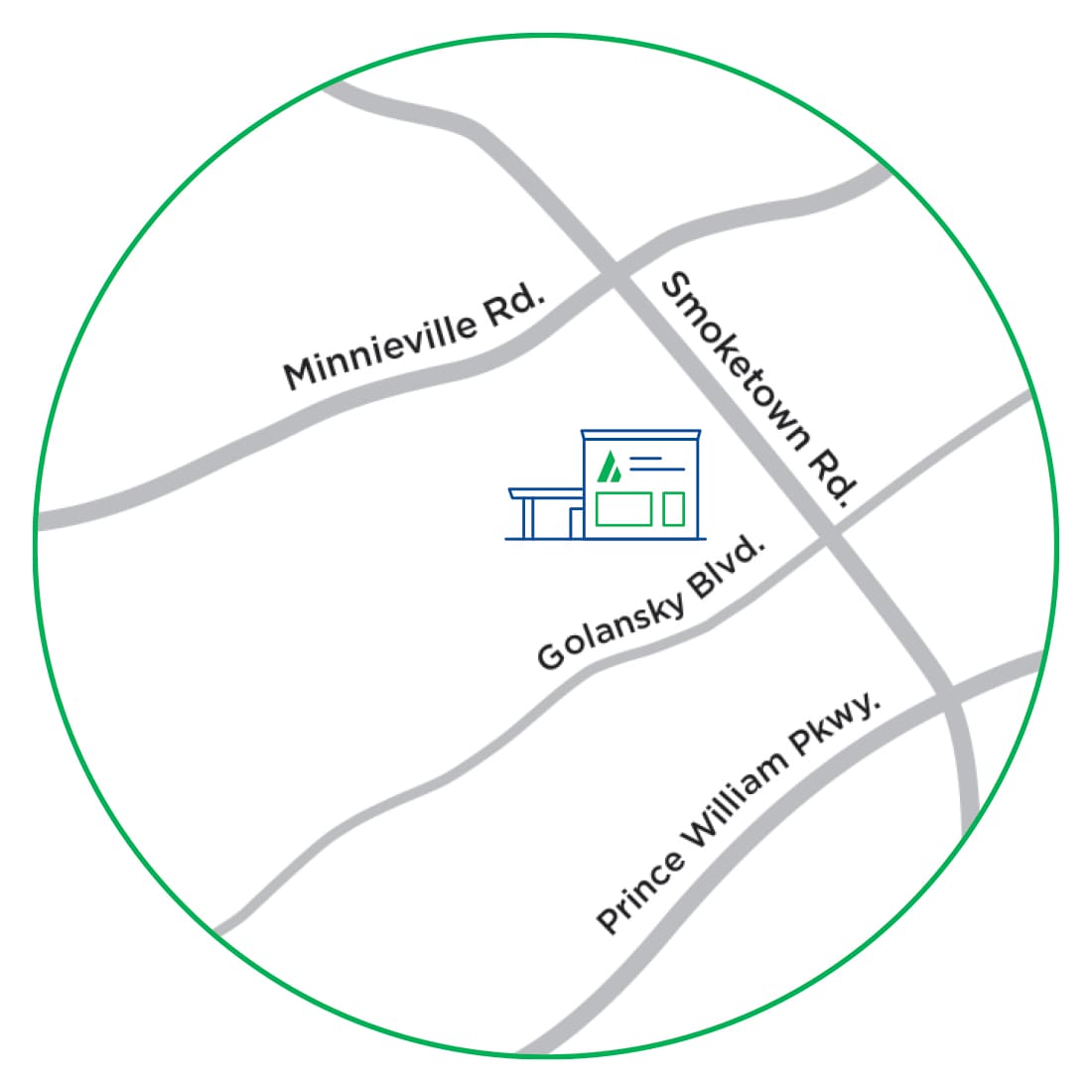

WOODBRIDGE, VIRGINIA BRANCH

We're opening a new branch near you

Join us on Saturday, April 12, 2025 at 13794 Smoketown Road in Woodbridge for our grand opening event from 10am to 1pm. Stop by to meet our team, and enjoy refreshments, family fun, games and prizes.

You can use your home equity for:

Debt Consolidation

Home Renovations

Tax Payments

Unexpected Expenses

PREDICTABILITY OF FIXED MONTHLY PAYMENTS

Lock in a fixed-rate option3 any time during your draw period

- Transfer all or part of your variable rate balances to a fixed rate

- Provides a defined payment amount and repayment term

- Have up to five Fixed-Rate Advances at one time

- Fixed-rate processing fee of $75, as allowed by applicable law

Fixed-Rate Advances are not automatically available through a draw or by writing a check. You must speak with a banker to obtain a fixed rate.

Need money now?

You may be eligible for an Access NOW™ loan4 that allows you to borrow against the approved credit limit without waiting for full approval and is paid off when you receive your HELOC funds.

Learn more

How much equity can you access?

FAQs

Disclosures

*Home Equity Line of Credit Prequalification Information: You have been prequalified for this offer on the basis of information contained in your consumer credit report that indicated you satisfied certain creditworthiness criteria. We will obtain a current consumer credit report and property valuation when you respond to this offer. You must continue to satisfy creditworthiness criteria used to select you for this offer, meet our pre-established standard credit terms and policies, and have verifiable income. If you are approved for a home equity line of credit, the actual credit limit and annual percentage rate that you receive will depend on your ability to meet the pre-established credit criteria. Rates are based on market conditions and borrower eligibility. Your prequalified offer for a home equity line of credit is available through 6/30/2025. The APR (Annual Percentage Rate) offered is 7.50%, is available with a minimum line amount of $50,000, a minimum initial rate advance at closing of $15,000, a maximum combined loan-to-value of 80%, and automatic deduction of monthly payments from an Atlantic Union Bank (“Bank”) checking account. Not all borrowers will qualify for the lowest rate. Borrowers must possess a Beacon Score of 720 or greater to receive the lowest rate. The offer is valid for applications received by 6/30/2025 and that close by 8/29/2025 at the Woodbridge office. The Annual Percentage Rate (APR) is variable and is based on an Index and a Margin. The APR will vary with the Prime Rate (Index) as published in the Wall Street Journal. As of 3/1/2025 the Prime Rate was 7.50% and the Margins ranged from -0.50% to 5.25%. The Index may vary due to a change in the Prime Rate, and Margins vary based on the credit limit amount, the loan-to-value ratio, the borrower’s credit score and other factors. The maximum APR is 24% or the maximum permitted by state law, whichever is less. The minimum APR shall be no less than 3.00%. Minimum monthly payment is $50.00, which may include principal. All offers are subject to credit approval. Offer is not available for advances taken under the fixed-rate option. Offer may not be available for existing Atlantic Union Bank Equity Line customers. This Atlantic Union Bank Home Equity Line of Credit has a 15-year draw period with a 15-year repayment period. Payments are interest-only during the draw period and the repayment period requires a principal and interest payment, based on the outstanding balance. There is no origination fee charged to open. Other fees may be charged at origination, at closing or subsequent to closing, ranging from $150 to $2,000. Bank must be in a valid first or subordinate lien position on the collateral. Property insurance and flood insurance, where applicable, will be required. This offer is limited to primary and secondary single-family residential real property located in Virginia, Maryland and North Carolina. Please consult with a tax advisor regarding interest deductibility. Certain conditions and restrictions may apply. There is a $50 annual fee, if and as allowed by applicable law, which is waived the first year. Your annual fee may be waived with a qualified Atlantic Union Bank checking account; consult with your branch banker for details.

1 Bank will pay closing costs for non-purchase money credit lines up to $400,000; credit lines of more than $400,000 will receive a $600 credit towards closing costs, or the full amount of closing costs, whichever is less. Closing costs include the first property valuation obtained by Atlantic Union Bank, but exclude any subsequent valuations not required by us and the initial funding of an escrow account when required. However, if your account is closed within three (3) years of the opening date, we will add any closing costs we advanced on your behalf to your outstanding balance for our reimbursement. Total closing costs generally range from $150 to $2,000.

2 Turnaround time from application to closing is impacted by the complexity of the application and customer responsiveness to information requests.

3Ability to have up to 5 fixed-rate advances at one time. Fixed-rate processing fee of $75, as allowed by applicable law. The interest rate is determined at the time of the fixed rate request using the Wall Street Journal rate plus a margin. The fixed interest rate will be higher than your standard variable rate. Margins are subject to change at any time. The fixed rate advance term selected can not exceed the full maturity date of the Home Equity Line of Credit account. For more details or to request a Fixed Rate Option, contact your local branch or schedule an appointment.

4 Access Now is an unsecured, short-term loan that is available for eligible customers that have been credit approved for a HELOC application. The maximum loan amount is equal to 50% of the approved HELOC line amount or $50,000, whichever is lower. Subject to standard credit criteria.