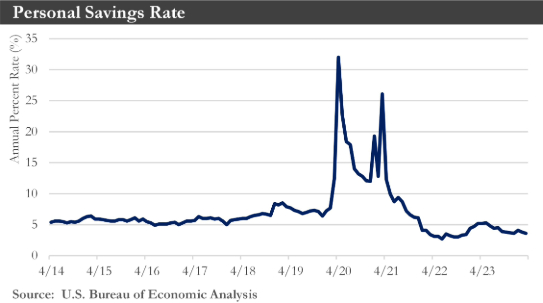

Consumer spending has been remarkably resilient lately, and another strong performance in Q2 would assist growth in personal consumption expenditures (PCE). However, many households have exhausted the savings accumulated during the pandemic and could face significantly higher debt costs and more subdued inflation-adjusted income growth. As such, real PCE growth would downshift in the second half of the year and average about 1.5% annualized in the final two quarters of 2024.

Some additional slowdown in business investment also seems likely as capital expenditure spending has remained challenged by higher financing costs. Manufacturing projects have boosted structures spending, but a sharp downshift in new commercial development appears set to drag down overall structures investment.

Although strong recently, the labor market has appeared poised for moderation. Payroll growth should average roughly 135,000 per month in the second half of the year, a downshift from the 245,500 averaged so far in 2024. Slower employment growth and improved labor supply should generate a slightly higher unemployment rate, which could peak at 4.0% in Q4-2024.

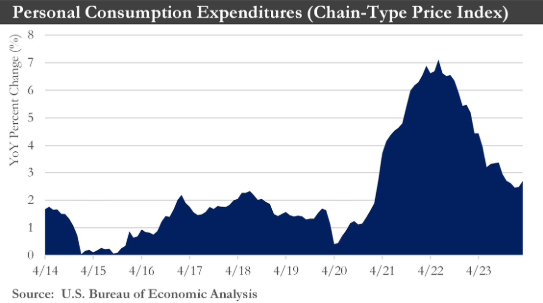

Although concerning, the recent bump in inflation does not appear to be the start of another rapid run-up in prices, and softer inflation readings should be seen over the next few months. The core PCE deflator should settle down and run at a 2.5% rate in the second half of the year. Consequently, two 25 bps rate cuts could occur in the Fall. The risks have been heavily skewed toward there being only one cut in 2024 as opposed to three cuts.

Inflation: U.S. inflation eased slightly in April, offering relief to investors and the Federal Reserve after a run of economic data at the start of the year revealed simmering price pressures. The consumer-price index (CPI) rose 3.4% in April from a year ago. Higher gasoline prices were partly responsible for the uptick in headline inflation. Core prices climbed 3.6% annually, the lowest increase since April 2021.

Thanks to a further decline in goods prices and some cooling in services price pressures, core inflation has recorded its softest monthly gain of the year. The 3-and-6-month inflation trends should gradually cool through the second half of the year and be in a place by late 2024 where policymakers would feel comfortable to begin dialing back the policy rate.

Consumer Spending: The American economy has continued to perform well, thanks in no small part to the continued resilience of its consumers. The wealth effect from gains in equity and real estate prices has been just as important in explaining this strength as excess saving.

Since the pandemic, gains in household wealth have been relatively widespread, with the less wealthy seeing the largest increases. More recently, however, equity prices have led the way, and gains have been concentrated more among the wealthiest households.

This may have implications for the types of spending over the next year, with sectors that cater to the high-end consumers (like financial services and travel) doing better than others. At the same time, high asset valuations would pose a challenge for monetary policy, requiring it to remain higher for longer in order to ensure that inflation would continue to move toward the central bank’s 2% target.

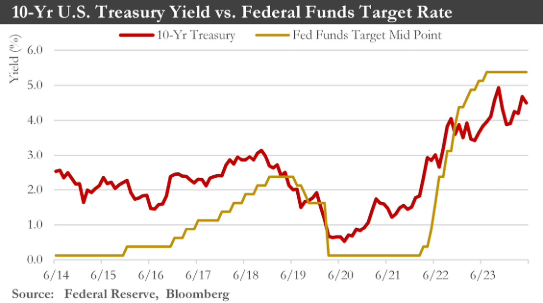

Monetary Policy: The Federal Reserve Open Market Committee (FOMC) has maintained the federal funds rate in the 5.25% to 5.50% range but announced a slowing of the pace of Quantitative Tightening (QT).

The rebound in inflation has pushed out rate cut expectations for 2024. Services inflation has been running hot, and the deflationary impulse on the goods side from normalizing supply chains has diminished. This is why the Fed was more hawkish regarding the progress on inflation, signaling an intent to wait longer to ensure that inflation will sustainably move to the 2% target. For the Fed to gain confidence, it would need the economy to show some signs of cooling. But with consumer spending running at a 2.5% quarter-on-quarter annualized pace, there has been little evidence that demand-driven inflation would likely ease soon. The first cut from the FOMC could come at its September meeting, though the timing of easing would be highly dependent on the incoming data. Any additional bumps on the inflation road would likely push that timing back, absent a marked deterioration in the labor market. However, if the Fed should begin to lower rates gradually later this year, this action could support increased manufacturing activity and new home construction.

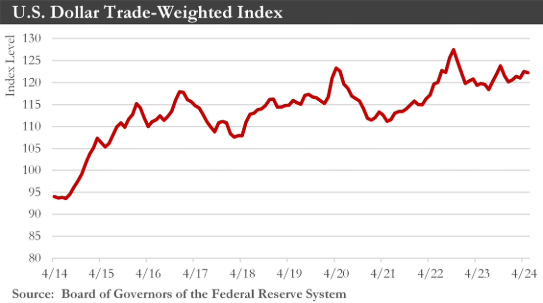

U.S. Dollar: The outlook for the U.S. dollar has changed little from a month ago, and U.S. dollar strength should persist through Q3 of this year. The initial September rate cut forecasted by the Fed is later than the monetary easing expected from several other major central banks, including the European Central Bank. The later Fed easing and, for the time being, reasonably resilient U.S. growth should be supportive of the U.S. dollar over the next several months. The trend of gradual U.S. dollar deprecation over the longer term at this juncture looks like it could begin in Q4 of this year, continuing through 2025. U.S. economic growth should slow over time while other major economies gradually recover. As the Federal Reserve also joins the trend of global monetary easing later this year, that will contribute to moderate U.S. dollar depreciation.

The Global Economy: The outlook for global economic activity in 2024 has continued to brighten, with global GDP growth to be around 3.0%. That would represent only a modest slowdown from the global growth of 3.2% seen in 2023. In China, Q1 GDP growth was stronger than expected, supported by government monetary and fiscal stimulus. While March activity and April sentiment data have still pointed to some slowdown ahead, China’s 2024 GDP growth should be about 5.1%. Firmer 2024 GDP growth in the Eurozone of 0.8% is expected. The eurozone economy experienced a mild technical recession in the second half of last year. However, firmer GDP data and sentiment surveys in early 2024 and strengthening trends in real household incomes now have suggested a stronger European economic recovery than previously thought. As the global growth outlook improves and inflation slows only gradually, foreign central banks should continue to adopt a more cautious approach to monetary policy easing.

Eurozone: The European Central Bank (ECB) should adopt an initial gradual pace of rate cuts as it embarks on its monetary easing cycle. Eurozone Q1 GDP surprised to the upside with growth of 0.3% quarter-over-quarter and 0.4% year-over-year. The rise in first-quarter GDP has confirmed the improvement seen in the region's sentiment surveys in recent months. The gain in Eurozone Q1 GDP was widespread, even if the strength of the rebound varied across the region's major economies. The Eurozone recovery should gather some momentum as the year progresses. Receding inflation has contributed to firmer growth in real household incomes, which should be supportive of consumer spending and overall economic activity. The European Central Bank (ECB) will likely take an initially cautious approach toward lowering policy interest rates. The ECB would likely cut its Deposit Rate by 25 bps to 3.75% at its June meeting, a move that has been widely signaled by ECB policymakers. The ECB may well then hold its Deposit Rate steady at its July meeting before resuming cuts with another 25 bps rate cut in its September announcement.

Outlook: The big question for the U.S. economy has been when inflation will subside or when the economy will slow under the pressure of higher interest rates, especially on the side of consumer spending. Either development could be sufficient to bring forward expectations for Federal Reserve interest rate cuts. The global economy could face a myriad of challenges; however, global economic growth has remained resilient. With that said the composition of global growth has started to change as the U.S. economy has shown clearer signs of deceleration while major foreign economies have demonstrated signs of recovery. Diverging paths for monetary policy has become a prominent theme in global financial markets. Select G10 central banks including the Fed and Reserve Bank of Australia—have leaned less dovish recently, while other G10 institutions have already started, or are about to start, lowering interest rates. Similar divergences have been apparent in emerging markets, where select institutions are easing while others have either kept rates on hold or have approached the end of their respective easing cycles. The U.S. dollar has continued to be primarily influenced by Federal Reserve monetary policy. With the Fed shifting to a slightly less dovish stance in the face of early 2024 inflation signals, the dollar could broadly strengthen over the next several months. Once the Fed makes a clear pivot to rate cuts, depreciation pressures could build on the greenback, and a downtrend in the dollar would persist for most of 2025. Economic growth trends becoming more favorable for international economies relative to the U.S. could also act as a long-term headwind for the U.S. dollar.

Sources: Sources: Department of Labor, Department of Commerce, Peoples Bank of China, Bloomberg, Eurostat, U.S. Bureau of Economic Analysis, Federal Reserve

Disclosures:

Past performance quoted is past performance and is not a guarantee of future results. Portfolio diversification does not guarantee investment returns and does not eliminate the risk of loss. The opinions and estimates put forth constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Securities are not insured by FDIC or any other government agency, are not bank guaranteed, are not deposits or a condition to any banking service or activity, are subject to risk and may lose value, including the possible loss of principal.

Atlantic Union Bank Wealth Management is a division of Atlantic Union Bank that offers asset management, private banking, and trust and estate services. Securities are not insured by the FDIC or any other government agency, are not deposits or obligations of Atlantic Union Bank, are not guaranteed by Atlantic Union Bank or any of its affiliates, and are subject to risks, including the possible loss of principal. Deposit products are provided by Atlantic Union Bank, Member FDIC.