Economic Recap: The U.S. economy continues to defy expectations in the face of high-interest rates. Consumer spending has been tracking a solid 2.6% pace in the first quarter, but households will likely have to dig into savings and wealth to maintain this pace in the future. Why? First, spending growth has outpaced income growth by a wide margin, leaving households increasingly reliant on credit. Second, excess savings are largely depleted for all but the highest-income households. Third, credit card and auto delinquency rates have risen beyond pre-pandemic levels. The latter is one of the clearest signals that financial strain is seeping into households, which will likely economize to a greater extent as time rolls forward.

Business investment has been performing as expected. It has cooled from a heartier pace in the first half of last year due to several factors. Businesses are responding to lower profits relative to the earlier phases of the recovery, absorbing higher financing costs, and judging their sales outlook against talk of an economic slowdown.

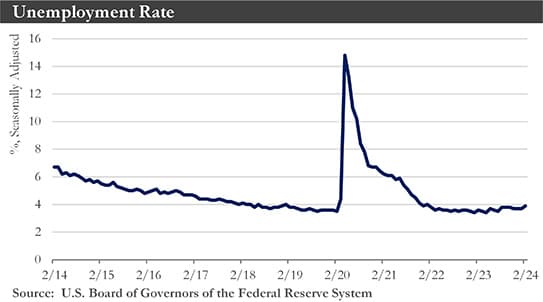

Their response is evident in recent hiring patterns. Private sector hiring slowed last year. Any downshift in economic momentum should correspond with lower hiring intentions, pushing the unemployment rate a bit higher to 4.2% or so by the end of this year. The job vacancy rate remains elevated relative to past historical cycles, even as it continues to trend down slowly.

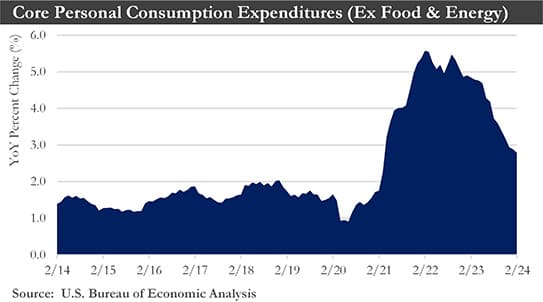

Resilient domestic demand and the solid labor market have stymied a previously favorable downtrend in inflation. These factors have started to dash hopes that the U.S. can achieve its 2% target without some degree of economic growth sacrifice. It also shows that the Federal Reserve was wise to be cautious in signaling that interest rate cuts were imminent. The first interest rate cut could be as soon as June.

Inflation: Inflation came out of the gate strong in 2024. The core Consumer Price Index (CPI) surprised to the upside in January and February, and over the past three months, it has been running at an annualized rate of 4.2%. The Fed’s preferred gauge, the core personal consumption inflation reading is expected to be down to 2.5% by the fourth quarter of this year. Although progress in reducing inflation this year will likely slow, it should decline as labor cost pressures cool, supply chains continue to normalize, and consumers grow more discerning in their purchases due to weaker gains in after inflation income.

Labor Market: Another month of solid nonfarm payroll growth in February demonstrated that the jobs market has yet to buckle under the weight of restrictive monetary policy. Underneath the recent payroll strength, however, lies widespread signs of the jobs market softening. The unemployment rate rose to a two-year high in February due to a decline in the household measure of employment rather than a surge in labor supply.

Meanwhile, demand for workers continues to slip, as indicated by the latest readings on hiring plans, job openings, and the use of temporary workers. The more subdued hiring environment will likely lead to the unemployment rate ticking up further this year. This more balanced labor market should help slow employment cost growth and reduce upward inflation pressure from wages.

Overall, the labor market remains incredibly tight and will likely need to show further signs of cooling before inflation can return to 2%. The fact that the labor market is showing little sign of deteriorating supports the case that Fed officials can be patient and continue to monitor the inflation data over the coming months.

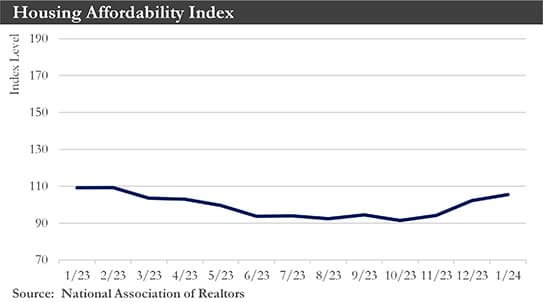

Housing Market: The residential sector looks set to improve in the years ahead. Mortgage rates have declined in recent months and are poised to fall further as the Fed Reserve begins to make monetary policy less restrictive.

Lower mortgage rates stand to boost existing home sales, which are expected to improve modestly. Although inventories are rising, reduced financing costs will likely keep demand slightly ahead of supply. Consequently, a modest pace of home price appreciation is anticipated moving forward. Continued home price appreciation means affordability is likely to remain a significant headwind.

Buyers are expected to continue to flock to the new home market, where availability and affordability are relatively easier hurdles. As a result, new single-family construction should continue to march higher over the coming years. By contrast, multifamily development is downshifting presently due to rising apartment vacancies and slowing rent growth. Given the recent pullback in multifamily permits, starts should continue to decline over the next few years.

Monetary Policy: The Federal Open Market Committee (FOMC) believes that inflation is returning to its 2% target, but it will likely be achieved slightly later than expected. The Committee is expected to ease policy at its June 12 meeting, when officials will have seen three more months of inflation and employment data. This year, the Fed will likely reduce the Fed funds rate by 50-100 bps. However, with the Committee more upbeat on prospects for economic activity and a bit more worried about inflation, the risk may be that the FOMC begins to ease a little later in the summer (at its July 31 meeting) or potentially proceeding at a slower pace.

U.S. Dollar: The U.S. dollar is expected to strengthen in the coming months due to the relative strength of the U.S. economy. Longer-term, it is likely headed toward a trend of depreciation. With the Fed easing in the second half of this year, interest rate differentials should favor foreign currencies. In addition, many major economies are expected to recover in the second half of this year. At the same time, U.S. economic trends will worsen in the coming quarters. Growth differentials should also act as a source of strength for foreign currencies over the long term.

And finally, with the Fed easing and the U.S. economy achieving a soft landing, global financial conditions should continue to ease going forward. Easier global monetary conditions should also act as a pillar of strength for foreign currencies and improve risk sentiment toward these currencies and markets. These dynamics should remain in place through the middle of 2025. Dollar depreciation is expected to be gradual, modest, and orderly.

The Global Economy: The global economy is expected to experience growth of around 3.0% in 2024, only a modest slowdown relative to last year. Among the advanced economies, Europe's growth is underwhelming and expected to be subdued in 2024. In Japan, a technical recession has been revised away, but activity remains lackluster. In the G10, the U.S. economy continues to outperform and be the relative shining star of the advanced economies.

Emerging market economies, on balance, have proven more resilient than their G10 peers, except for the U.S. China's secular slowdown, which appears to be intact. In contrast, India's economy continues to show promise and can grow over 7% this calendar year. Mexico's economy continues to benefit from strong U.S. economic trends. While growth may slow in the second half of this year, Mexico's economy will likely avoid recession in 2024 and grow approximately 2% this year. This year, emerging economies are expected to contribute the most to global GDP growth.

China: China's economy is still on track to slow down from 2023, reflecting the ripple effects of the overbuilt conditions in the housing market. The government has set a 5% target for real GDP growth in 2024. Previously announced stimulus measures should help growth this year, but this will only be a band-aid fix absent fundamental structural reforms. China's economy will continue to struggle with its long-term growth prospects. In the meantime, excess capacity in China's good-producing sectors is lending a hand to cooling global inflation, offering a timely offset to the rise in shipping costs from the conflict in the Red Sea.

Outlook: Growth prospects worldwide are on diverging paths, with the U.S. outperforming peer-advanced and most emerging market economies. However, as 2024 progresses, these diverging paths are expected to flip and for international economies to outperform the U.S. in the second half of this year. Slower U.S. consumer spending should lead to subdued U.S. economic activity, while foreign economies currently in recession or experiencing modest growth should be in recovery mode in the latter quarters of 2024.

Diverging growth prospects should also lead to diverging monetary policy paths. Central banks will likely move at differing speeds when considering pivots to easier monetary policy. Receding inflation and weak growth could make the European Central Bank one of the earliest major G10 institutions to lower policy rates.

U.S. economic outperformance, relative to peer economies, along with a cautious Fed, have driven and should continue to drive dollar strength early this year. However, a foundation for foreign currency strength will be built in the long term as international economies recover and U.S. economic exceptionalism starts to fade. In addition, Fed rate cuts combined with a U.S. soft landing and easing financial conditions should lead to an overall dollar downtrend against G10 and emerging market currencies that persist into mid-2025.

Capital Markets Commentary

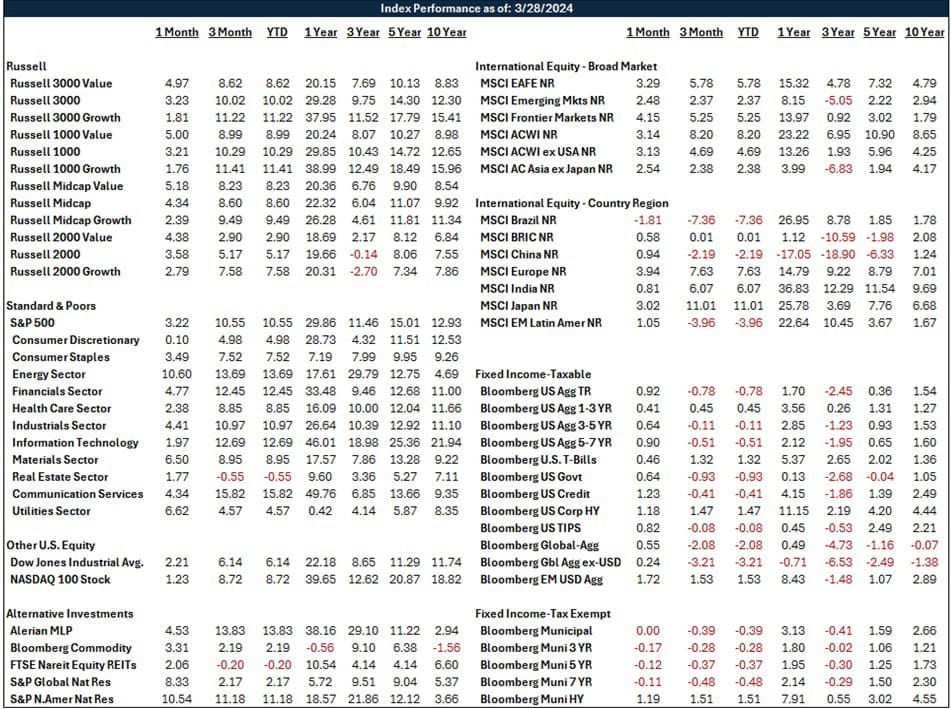

Recap: Stock markets globally posted strong first-quarter returns for the most part, which added to the substantial gains achieved in 2023. After a solid performance in 2023, bond markets struggled with rising interest rates as investors reacted to higher inflation readings as the year began. Markets seem to have responded to the unexpected resilience of the U.S. economy and its labor market despite the headwinds of still elevated inflation and high-interest rates. While many investors expected the Federal Reserve to begin cutting interest rates by now in this cycle, the Fed appears in no rush to cut rates in the face of solid economic performance, concerned that rate cuts could keep inflation at higher levels than they prefer.

U.S. stocks across the capitalization and style spectrum delivered robust gains in the first quarter. Every capitalization and style type posted gains for the quarter. In a continuation of recent form, growth-style stocks handily outpaced value stocks. The S&P 500 was up 10.3%, the Russell Mid Cap Index was up 7.9%, while Small-Cap stocks were up only 3.6% in Q1. All, however, represent outstanding returns that are well above historical norms for a quarter of investment results.

Bond performance, however, struggled with interest rates rising on the benchmark 10-year U.S. Treasury from about 4.0% to 4.3%. The Bloomberg Aggregate Index, representing a broad cross-section of the bond market, posted a -0.8% return for the first quarter. With signals that the Federal Reserve will hold off cutting rates for now, short-term bonds outpaced longer-term maturities. Not surprisingly, corporate bonds with higher credit risk than U.S. Treasuries posted lower returns in this rate environment. Corporate bonds were down -.0.5% for the quarter, while even riskier junk bonds were up 1.5%, while the Bloomberg Global Aggregate Bond Index ex-U.S. bonds was down 1.6%.

Outlook: The outlook for stock returns in the near to intermediate term, despite the strong returns of 2023, remains uncertain given a resolute Federal Reserve in its battle to fight inflation and what are, by historical standards, stock prices with seemingly stretched valuations. Corporate earnings growth will likely need to pick up speed to justify current stock price to earnings multiples. Expensive valuations are especially true for the handful of market-leading growth stocks referred to as the "Magnificent Seven" (i.e., Alphabet, Amazon, Apple, Meta, Microsoft, Tesla, and NVIDIA). The NASDAQ 100 Index, about 50% comprised of these stocks, finally gave up the performance leadership reins in Q1 and trailed the broader S&P 500 by nearly 2%. This change in performance leadership may be an early sign that market performance is beginning to broaden with more favorably priced but slower-growing non-technology and cyclical stocks finally getting recognized by investors. Time will tell.

The outlook for bonds continues to look rather bright, mainly due to the likelihood that the Fed is closer to the end of its rate hiking cycle, inflation is slowly coming down, and now bonds offer a respectable coupon rate after years of ultra-low interest rates. Bond coupon rates finally provide real competition for investment dollars versus stocks for more conservative income-oriented investors, given the more expensive investment profile of stocks.

There continue to be downside risks to the capital markets, which should be kept in mind as 2024 unfolds. Those risks include gridlock in a hyper-partisan Congress over essential issues like the federal budget, immigration, and funding conflicts in Europe and the Middle East. The latter is already impacting trade as ships with cargo are forced to take longer, more expensive routes around the southern tip of Africa to avoid blockades and conflicts near the Suez Canal. And we should remember the races for the Presidency and Congressional seats that are heating up. Presidential years tend to be positive years for equity returns (though past performance does not guarantee future results).

Also, historically, the Federal Reserve has tended to avoid changing its monetary policy in any meaningful way as elections approach so as not to appear partisan. What was a forecast that the Fed might cut rates 6-7 times this year has turned into a more modest outlook on rate cuts, with perhaps only 2 or 3 cuts coming this year. And finally, if forces that could negatively impact inflation (like the price of oil, commodities, wages, or increased demand for goods and services) slow the decline of inflation or even reverse it, it would be unlikely the Fed could cut rates as much as markets are expecting, if at all. Any combination of the above risks could disappoint investors.

The longer-term view of markets suggests that the tailwinds stock and bond investors enjoyed in recent years, including massive fiscal stimulus and declining and ultra-low interest rates, will not resurface soon to smooth over inevitable hard economic times. Securities’ values are more likely to be driven by the organic operational successes of businesses rather than help from the federal government. These conditions should favor astute stock and bond selection.

Sources: Department of Labor, Department of Commerce, Bloomberg