Recap: The U.S. economy has defied rolling predictions of imminent recession, powering through higher rates over the last two years. Lower interest rates will offer support as the unique buffers shielding the economy from a downturn, including pandemic-era savings cushions and immigration surges that have boosted spending start to fade.

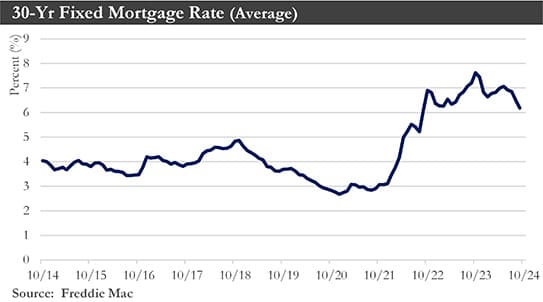

Low and middle-income consumers’ budgets have been showing signs of strain. The U.S. housing sector, which avoided a downturn often occurring when interest rates rise sharply, is facing a weakening outlook. Today’s pool of would-be buyers has lower income and wealth profiles than those who bought homes when mortgage rates first soared above 6% two years ago.

Many homeowners have held their homes off the market, initially limiting competition for home builders. That has ended now as inventories have risen. Meanwhile, an apartment building boom that kept construction workers on job sites has concluded.

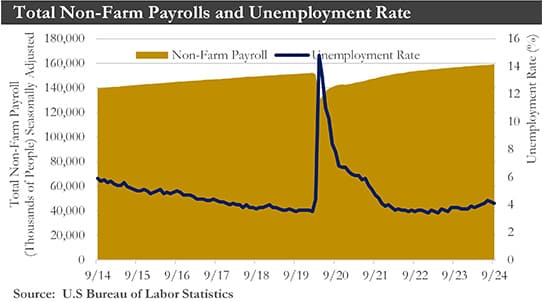

In the labor market, companies have slowed hiring. Layoffs have remained low, but what looked like a controlled demolition of labor demand may reach a tipping point.

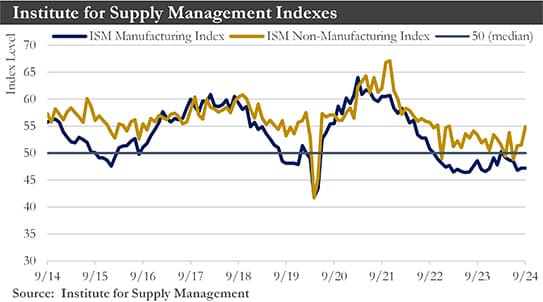

On the production side, the ISM Manufacturing Index slipped again in August, remaining in contraction territory for the sixth consecutive month. The sector continued to experience weakness in demand as the new orders and export orders indexes slid deeper into contraction. The ongoing weakness in the sector rekindled some concerns over the economy's health. On the services side, however, things were better, with the ISM Services Index springing back to life in September, offsetting much of the weakness evident in the manufacturing sector.

The government’s second estimate of Q2’s real GDP growth was revised higher by 0.2 percentage points to 3.0% annualized from the end of last quarter. An upward revision in consumer spending was largely responsible for last quarter's upgrade.

The Federal Open Market Committee (FOMC) announced a 50-bps reduction in the federal funds rate to a target range of 4.75%-5.00%. This commencement of monetary policy easing comes when overall economic growth has remained solid, supported by stronger-than-expected retail sales, industrial production, housing starts, and initial jobless claims. This cut has exposed a picture of an economy still expanding in the 2-2.5% range. Yet, early signs of labor market weakness have posed meaningful threats to the sustainability of growth, underpinned the Committee's decision to front-load policy easing by starting the easing cycle with a larger than typical 50 bps cut rather than a conventional 25 bps move. The FOMC should opt for a smaller 25 bps cut at its two remaining meetings this year. A strong September jobs reports however calls into question the timing and level of future cuts.

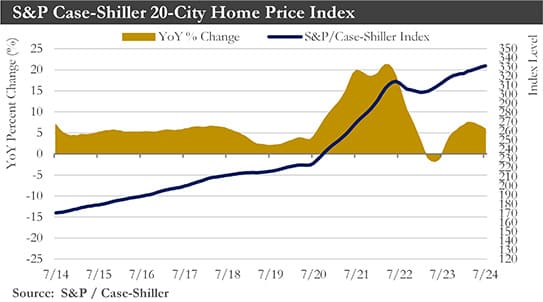

Housing: A structural imbalance in the housing market between underlying solid demand and scarce supply has threatened to clog a critical channel through which monetary policy typically works. Mortgage rates have declined over the last few months, but the drop has yet to lead to a discernable pickup in mortgage demand.

Home sales have also been slow to respond. Existing home sales have remained remarkably sluggish and on par with the tepid pace experienced in the aftermath of the Great Recession. Home prices have risen sharply over the past four years. Looking ahead, homes should stay out of range for many buyers as supply and demand remain misaligned and existing home prices continue climbing.

Meanwhile, the new home market has continued to outperform. Home builders have dodged the full effects of restrictive monetary policy by providing buyers with mortgage-rate buydowns and other pricing incentives. As a result, new home sales have held up comparatively well this cycle. However, the new home supply could be elevated for current demand. Consequently, builders have scaled back production for the time being. All told, lower rates should eventually boost the residential sector. This positive impulse could take longer because of poor affordability conditions and an elevated supply of new construction.

Labor market: Non-farm employment rose by 254,000 in September, and the unemployment rate dropped 0.1 percentage points to 4.1%. Job gains in the two prior months were revised higher by 72,000, leaving the three-month average pace of hiring at 186,000 compared to a 203,000 monthly pace in the past year.

The labor market has cooled somewhat due to a weaker pace of job creation though, the rise in the unemployment rate in recent months has been partly reversed. There just is not enough evidence to suggest that the recent softening in early Q3 would be the start of a more severe deterioration in underlying labor market fundamentals.

Inflation: Inflation should grind lower in the coming months. While seasonal factors have not been as favorable as earlier this summer, inflation pressures have generally abated. The more tepid jobs market has continued to put some downward pressure on income growth and the demand that results from that income. Improving productivity has helped to keep unit labor costs benign. With commodity prices largely in check, it has become harder for businesses to pass on price increases as consumers have become more discerning. Core Consumer Price Index should ease to around 2.5% by the middle of next year, with the core Personal Consumption Expenditures Index subsiding to around 2.25%.

Small Business: Small business confidence retreated in August, fully erasing the improvement made in July. The National Federation of Independent Business’s Small Business Optimism Index fell 2.5 points to 91.2 in August. The decline reflected worsening earning trends and a deterioration in expectations for future sales and business conditions. With the impending election, uncertainty among small business owners has been rising.

U.S. Dollar: The U.S. dollar softness should prevail overall through mid-2025, driven by what should be a relatively active Federal Reserve easing cycle, and as U.S. economic growth slows through late this year and into early 2025. However, by the middle of next year, as Fed easing ends while other major central banks could continue to lower interest rates steadily, the U.S. dollar should stabilize and gradually begin to strengthen. That trend toward U.S. dollar recovery should be reinforced in 2026 as U.S. economic activity continues to pick up, with growth likely to exceed that of the other G10 economies during that period.

Eurozone: Following a period of stagnation in the second half of last year, the Eurozone economy has returned to an expansion path during 2024, although the pace of growth has been unimpressive. Q2 GDP rose just 0.2% quarter-over-quarter and 0.6% year-over-year.

While economic indicators have been mixed, the outlook has remained for moderate and positive economic growth in the quarters ahead. With employment gradually growing, Eurozone real household income trends should remain favorable.

Given declining profit growth and falling capacity utilization, the outlook for business investment has not been as constructive. An improving outlook for Eurozone consumers should outweigh the clouded outlook for businesses, and Eurozone economic expansion should continue, albeit at a modest pace.

Even in the context of this underwhelming Eurozone growth outlook, lingering concerns about the inflation outlook have remained. For these reasons, the European Central Bank will likely continue lowering its policy rate at a steady 25-bps-per-quarter pace (at every other meeting), which would see the policy rate reach 2.25% by the end of next year.

China: China's economic plight has deepened, and pressure has been heaped on Beijing to step up support for households or risk getting stuck in a low-growth environment beset by tumbling prices and squabbles over trade. Figures released in recent weeks showed activity weakening across the board, with home prices recording their steepest annual fall in nine years. Consumer confidence sank in July while inflation remained pinned near zero. Business surveys in August recorded sinking profits and swelling inventories at Chinese manufacturers. Yields on 10-year Chinese government bonds have plummeted to new lows, indicating investors have soured on the economy’s prospects.

The root of China’s problems has been a still-festering property meltdown, which has sapped government revenue, held back investment and prevented consumers from spending more freely.

Beijing has tried to compensate for its domestic weakness by juicing factory output and exports and reorienting investment away from real estate and toward advanced manufacturing and other high-tech sectors, thereby forging a stronger and more self-sufficient economy.

Beijing has signaled more help is on the way. They recently announced a record cut in interest rates and a large package of stimulus measures.

Outlook: Overall, the U.S. economy has shown ongoing resilience through the third quarter, as evidenced by the breadth of gains across domestic drivers. While lower rates will support a gradual slowdown, certain elements of this strength could begin to fade. The uptick in second-quarter personal consumption expenditures was driven by a rebound in goods spending that may not continue, particularly given the recent softening in labor market fundamentals. Second, the sharp acceleration in equipment outlays could be traced back to a surge in aircraft purchases last quarter and is unlikely to be repeated in the third quarter. Lastly, the gain in federal spending resulted from a notable bump in national defense outlays, which would revert over the coming quarters. Overall, growth should gradually edge lower through the year’s second half, allowing inflation to drift closer to the Fed’s 2% target. This economic softening could enable the FOMC to cut its policy rate by at least 75 basis points by year-end.

While the pipeline of apartments under construction has been robust, lower financing costs will likely incentivize more multifamily building as rental demand remains firm amid poor affordability conditions in the for-sale market. Existing home sales dropped in August. Homebuyers likely did not realize the recent decline in mortgage rates in August, as interest rates have been typically locked in a month or two before the sale closes. Lower mortgage rates should spark demand, but steady home price appreciation will constrain affordability.

Relief on borrowing costs has also been set to support consumer spending. Retail sales increased in August, but the details pointed to a concentrated source of growth in e-commerce. Annual growth in total retail sales has averaged 2.3% thus far in 2024, a noticeable step down from the 3.5% average over 2023. The downshift has illustrated an increasingly choosy consumer and supported a less restrictive monetary policy environment to encourage broad-based consumption growth.

Capital Markets Commentary

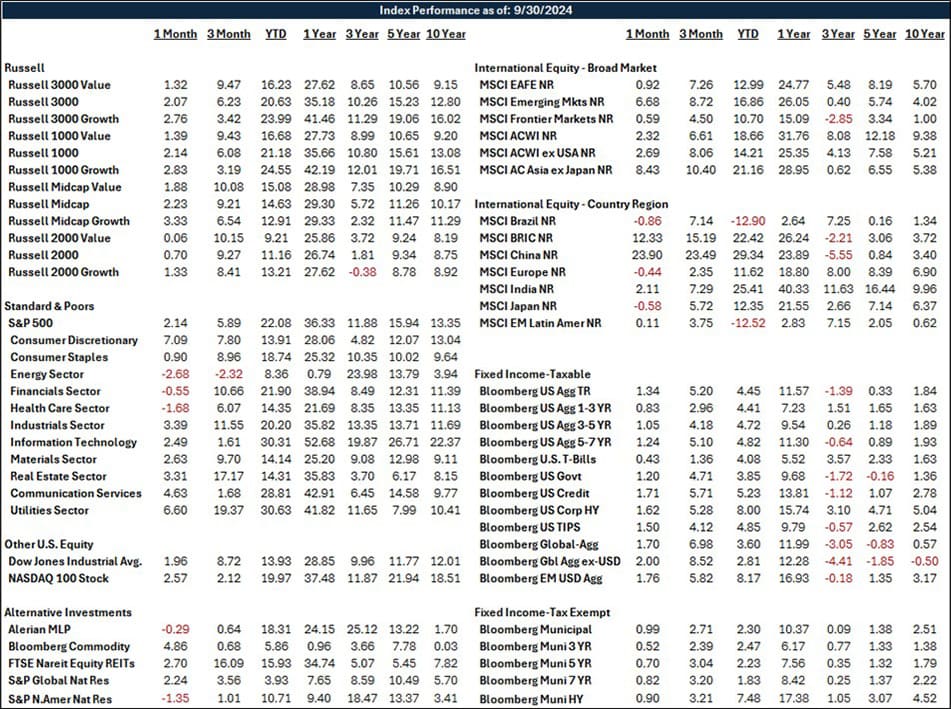

Recap: Stock markets globally posted strong third-quarter returns, with investor sentiment broadening to most economic sectors. Performance leadership shifted from U.S. Technology and Communication Services stocks to more defensive and economically sensitive ones. Utilities, Real Estate, Industrials, and Financials stocks led the way with sector returns of 19.4%, 17.2%, 11.6%, and 10.7%, respectively. Technology and Communication stocks were up 1.5% and 1.7%, respectively. Energy stocks were the only area of the U.S. market that failed to produce a positive return, declining -2.3 % for the quarter. Bond markets posted positive results in Q3 as interest rates began to decline across the yield curve in anticipation of the Federal Reserve pivoting and beginning a rate-cutting cycle. The larger-than-expected cut in rates by the Fed lifted the market and investor sentiment.

Large-cap U.S. stocks delivered solid gains in the third quarter, with leading performance rotating to previously out-of-favor parts of the market. Market gains were broad across most economic sectors, but leadership was concentrated in value-style stocks. Stocks in the Utilities, Real Estate, Industrials, and Financials sectors were all up double digits. The Russell 1000 Value Index was up 9.4%, while the Russell 1000 Growth Index was up 3.2%. The broader S&P 500 was up 5.9%, the Russell Mid Cap Index was up 9.2%, while Small-Cap stocks in the Russell 2000 were up 9.3% in Q3.

Bond market performance was positive in Q3 as investors anticipated the Federal Reserve's pivot toward a lower-interest monetary policy, bringing the entire yield curve to lower interest rates. The benchmark 10-year U.S. Treasury ended the quarter at around 3.7% at quarter's end, substantially lower than just a quarter ago, while the 90-day U.S. Treasury Bill ended the quarter at 4.6%. The Bloomberg Aggregate Index, representing a broad cross-section of the bond market, posted a 5.2% return for the third quarter. Not surprisingly, corporate bonds with higher credit risk than U.S. Treasuries posted higher returns, with the Bloomberg U.S. Credit Index up 5.7% for the quarter. Riskier junk bonds were up 5.3%, while the Bloomberg Global Aggregate Bond Index ex-U.S. bonds were up 8.5% as the U.S. dollar began to soften.

Outlook: The outlook for stock returns in the near to intermediate term remains uncertain despite the strong returns of 2024 year-to-date. Corporate earnings in Q3 are forecast to weaken compared to Q2, and expensive stock valuations make strong stock market advances from these levels suspect. The general expectation is that the economy will weaken over the next few quarters before recent and future rate cuts filter through to the economy. Stocks that led the market's advance with solid earnings growth in recent quarters have fallen back. Now, leadership is broadening to stocks that are growing but not nearly the pace of the artificial intelligence darlings.

The outlook for bonds continues to look bright, mainly because the Fed is likely to continue cutting interest rates, and inflation will likely continue to slow.

There continue to be downside risks to the capital markets, which should be kept in mind as 2024 unfolds. These include political gridlock in Washington, D.C., the expanding war in the Middle East and Europe, and hotly contested races for the Presidency and congressional seats that are in their final weeks.

The longer-term view of markets suggests that the tailwinds stock and bond investors enjoyed in recent years, including massive fiscal stimulus and declining and ultra-low interest rates, will not resurface soon to smooth over inevitable hard economic times. On top of that, the unusual expansion of stock valuations from extreme investor enthusiasm for stocks over investment themes like artificial intelligence will run its course. These conditions should favor patient, astute stock, and bond selection.

Sources: Institute for Supply Management, Department of Labor, Department of Commerce, Bloomberg, National Federation of Independent Business, Federal Reserve, European Commission