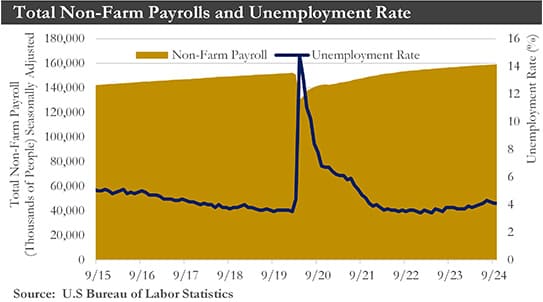

Third Quarter Recap: The third quarter ended with a bang. Nonfarm payrolls blew past expectations in September, rising 254,000 over the month. At the same time, employers have remained reluctant to let go of their existing workers. Cooling wage growth and firming labor productivity growth have helped to quell the labor market's inflationary impulse, which has added credence to the Federal Reserve’s decision to opt for a 50 bps rate cut in September to support overall job growth.

On the production side, the ISM Manufacturing Index was unchanged in September, remaining in contraction territory for the sixth month. However, things looked better on the services side, with the ISM Services Index rising notably in September. Overall, the services sector has continued to hold its ground, offsetting much of the weakness in the country's manufacturing sector.

Looking through recent idiosyncratic shocks, the long lags of restrictive real interest rates have fed through to the business sector. The commencement of monetary policy easing has spurred lower Treasury yields and mortgage rates but borrowing costs have remained elevated relative to their pre-pandemic norms. As the Federal Reserve reduces its target range for the fed funds rate in the coming months, growth in interest-rate sensitive sectors should gain firmer footing around mid-2025.

However, significant disruptions have threatened the health of the economy. Hurricanes Helene and Milton devastated parts of the southeastern United States. The destruction has depressed near-term economic activity and has negatively impacted employment surveys. A rebound should occur as cleanup, and rebuilding has begun, and normal economic activity eventually will resume. The timeline for this, however, is still being determined.

Congress passed a continuing resolution through December 20th to avoid the risk of a government shutdown. However, with federal government funding and the debt limit suspension expiring at the end of the year, fiscal risks would remain in the year's final two months.

Housing: Lower mortgage rates over the past few months and the official start of the Fed's easing cycle at its September meeting have brightened the outlook for the housing market. Single-family housing starts rose 2.7% in September as permits notched their third sequential gain. Although the uptick in permits was modest at 0.3% in September, it has solidified a rising trend in single-family permits following a five-month string of declines.

In contrast to the pronounced weakness in existing home sales, new home sales have remained relatively sturdy due to builder pricing incentives and plentiful inventory levels. The pace of single-family building should gradually improve over the next year, aided by marginal dips in financing costs for builders and mortgage rates for buyers. That said, recent mortgage rate volatility has been a reminder that financing costs could remain elevated for some time, inhibiting a full housing market recovery.

Labor market: The U.S. hiring pace picked up strongly in September, and the unemployment rate was 4.1%. This shows that the U.S. economy has continued momentum in the month since the Federal Reserve delivered its first interest rate cut in four years. U.S. employers added 254,000 jobs in September. Over the past three months, payroll gains have averaged 186,000, slightly below the 203,000 averages over the prior twelve months.

The somewhat stronger picture of the jobs market has also extended to earnings growth. Average hourly earnings posted an increase of 0.4%. Although still noticeably above the pace that prevailed over the past cycle, this firming in wage gains in September should not indicate a risk likely to derail the current downward trend in inflation. The underlying trend in the labor market has gradually been cooling, and a pickup in productivity growth has further tempered the inflationary pressures from the labor market.

The strong September jobs report offered an encouraging sign that labor market conditions may have stabilized. Demand for new workers has turned merely lukewarm, as indicated by the downward trend in job openings, contractionary Purchasing Managers Index employment readings, a decrease in small business hiring plans, and faltering consumer perceptions of job availability. Fortunately, layoffs have remained low, but an upturn could lead to a further downshift in net payroll growth, with firms reluctant to hire new workers.

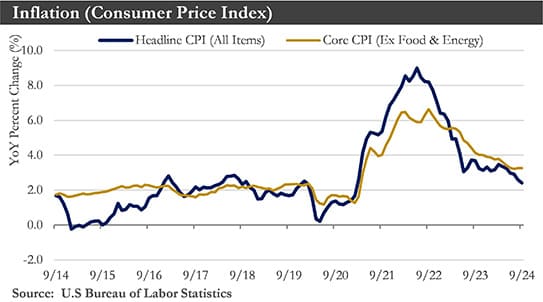

Inflation: The bumpy ride to slower inflation continued in September. Headline CPI rose 0.2% in September, while core inflation was a tenth stronger at 0.3%. The September CPI report has remained consistent with the view that further improvement will likely be slow while the overall trend in core inflation will likely remain lower. The deflationary impulse to goods prices has decreased with supply chain pressures no longer receding and inventories largely replenished. The drop in overall inflation from food and energy has also weakened, with the risks to energy costs for the time being seeming to lie to the upside. However, services inflation should continue to slow as housing inflation eases further, and service providers could benefit from tamer input cost growth for goods and labor.

Small Business: Small business confidence ended the third quarter roughly unchanged from the start of the year. The NFIB's Small Business Optimism Index rose 0.3 points to 91.5 in September. Despite continued economic strength, elevated uncertainty has constrained small business sentiment with the NFIB's uncertainty index hitting its highest level on record in September.

On a more positive note, labor market metrics in the NFIB survey have broadly returned to their pre-pandemic levels. Hiring intentions have eased below the pre-pandemic pace, while September's sharp decline in the share of firms with positions they could not fill put it soundly back into pre-pandemic territory. The softening labor conditions have filtered through to wage metrics and, by extension, selling prices. These developments should lead to further progress on returning inflation sustainably to the Federal Reserve's 2% target.

Eurozone: After a steady expansion during the first half of 2024, the Eurozone economy appears to have lost momentum in recent months, a trend reflected in a decline in both the Eurozone manufacturing and service sector Purchasing Managers Indexes in September. Investment spending, in particular, has been weak, while consumer spending has shown only modest gains despite growth in real household incomes.

In October's monetary policy announcement, the European Central Bank (ECB) lowered its Deposit Rate by 25 bps to 3.25%. The decision was widely expected, coming in the wake of a recent weakening in sentiment surveys that hinted at a slower pace of expansion and a lessening of price pressures, as well as the September Consumer Price Index, which confirmed ongoing gradual disinflation.

The ECB should announce rate cuts of 25 bps in December 2024, January 2025, and March 2025. As ECB policy rates move closer to a neutral level, the central bank could pare back the pace of its rate cuts to a quarterly frequency.

China: China's strong start to the year toppled under the weight of a shrinking real estate sector and depressed consumer demand. The result was an economy flirting with deflation. There is a real risk that China will miss the growth target set by authorities, with government stimulus measures proving insufficient to revive consumer and business confidence.

Economic growth moderated through the third quarter but showed some signs of life in September. Q3 GDP rose 0.9% quarter-over-quarter while growth eased only slightly to 4.6% year-over-year. Overall, the latest batch of Chinese data has remained somewhat mixed, and with stimulus measures unlikely to provide a long-lasting boost to the economy, the outlook has remained for Chinese GDP growth of 4.6% in 2024.

Outlook: Over the past quarter, developments in the U.S. economy have generally cooled. However, economic growth has remained above 2%. The labor market has also returned to balance, and inflation has begun a convincing descent towards the 2% target. The Fed has indicated it can lower interest rates without stoking too much heat into the economy.

Economic growth should continue slowing towards 2% by the end of the year. Consumer spending has been resilient thus far. However, the central bank must be mindful of the headwinds from the erosion of pandemic-era excess savings and rising delinquency rates across products and credit quality. Consumers have felt the weight of high interest rates and need relief, particularly now that labor demand has returned to its cooler pre-pandemic level. Likewise, housing demand should improve next year, coming off tough affordability conditions.

Fortunately, business investment has fared better than anticipated. However, this, too, could lose some of its heat. The transportation segment still has room to recover as borrowing costs come down. So, while overall business investment should slow modestly over the next year in line with the economy, the easing interest rate cycle would limit the downside.

Sources: U.S. Department of Labor, U.S. Department of Commerce, Federal Reserve Bank, Bloomberg, People's Bank of China, European Central Bank