Recap: Recently, two noteworthy themes have emerged in the U.S. economy. Firstly, there have been tentative signs that U.S. economic outperformance is declining. The core of the U.S. economy has performed steadily during early 2024, but there have been some signs of slowing around the edges.

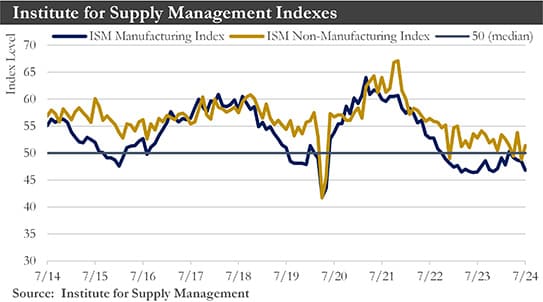

While sentiment surveys have shown some month-to-month volatility, the U.S. Institute for Supply Management Manufacturing Index has generally remained in contraction territory. In addition, the ISM services index has softened.

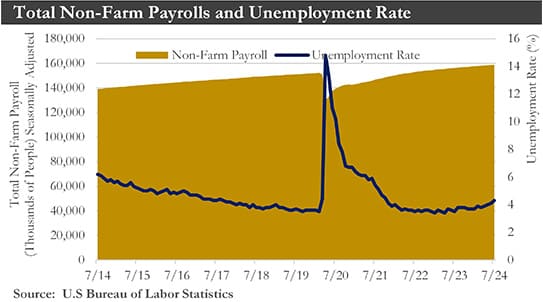

Hints of a possible slowdown in the U.S. labor market have also been evident. While non-farm payrolls recorded another solid 206,000 gain in June, more timely or forward-looking indicators such as initial jobless claims, job openings, and temporary help employment have pointed to a softening jobs trend ahead.

And finally, growth in household incomes has fallen below growth in consumer spending and could be a headwind to consumer spending moving forward.

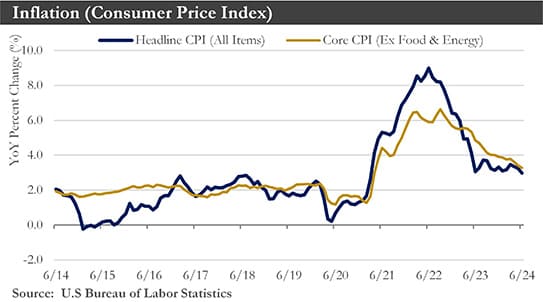

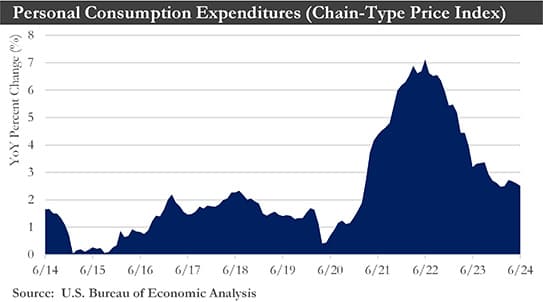

Secondly, while U.S. inflation, especially services inflation, was stubbornly persistent during the early months of this year more recent U.S. inflation readings for May and June have been encouraging. U.S. Core Consumer Price (CPI) Inflation slowed to 3.3% in June—the smallest 12-month increase since April 2021. With the U.S. perhaps having seen some decline from demand-driven inflation as growth begins to slow, the outlook for Federal Reserve monetary policy should be for the moment unchanged.

Inflation: U.S. inflation eased last month, further extending a recent slowdown in price increases. The CPI fell 0.1% in June. On a twelve-month basis, CPI edged lower by 0.3 percentage points to 3.0%. Core inflation prices (i.e., CPI minus food and energy costs) rose a modest 0.1%, a deceleration from May's already soft 0.16% gain and considerably below the hotter 0.37% monthly readings averaged through the first three months of the year.

This is precisely what the Federal Reserve has been looking for. The long-awaited downward adjustment on shelter prices appeared in the data. At the same time, core goods prices have continued to edge lower. Encouragingly, the three-month annualized rate of change on core inflation fell sharply to 2.1% – the softest reading since March 2021.

Should the next two inflation readings remain soft, a September interest rate cut could be very much in play, especially if the labor market has slowed in a way that either diminishes a potential source of ongoing inflation or risks further unwelcome economic weakness.

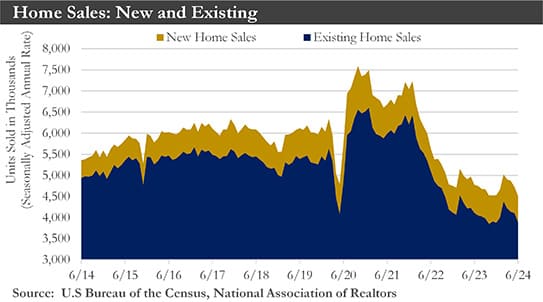

Housing Market: High interest rates have suppressed demand in the housing sector. Mortgage rates rose recently as sticky inflation in the first quarter prompted a rise in rate expectations. Homebuying broadly retreated in response, giving way to new and existing home sales declines.

The new home market has softened recently alongside higher mortgage rates, increased availability of existing homes, and a moderated pace of economic growth. These factors could remain a constraint moving forward.

Builders appeared to be scaling back production as the headwinds created by restrictive monetary policy have become more intense. Financing their operations has become more expensive, and demand appears to be declining due to high mortgage rates, increased supply in the resale market, and slowed cooling labor market conditions.

Looking ahead, the Federal Reserve appears poised to initiate a rate-cutting cycle later this year, which should help mortgage rates fall further. While lower rates likely would help improve affordability conditions for buyers and make pricing incentives less of an imperative for home builders, a deteriorating macroeconomic backdrop marked by higher unemployment and slower income growth would continue to be a headwind for the housing market.

Labor Market: The July job report continued a run of remarkable U.S. job-market resilience, which has continued even as the Federal Reserve has kept interest rates at their highest level in more than two decades. The U.S. added 206,000 jobs last month.

However, hiring activity has slowed, and the labor market has come into better balance. The hiring rate, quit rate, and job opening to unemployed ratio have been at or below pre-pandemic levels. Softening fundamentals have now pushed the unemployment rate to a new cycle high of 4.3%, which outside of the pandemic has not been seen since early 2018.

Average hourly earnings were up 3.9% from a year earlier in June, marking their smallest gain since 2021. The Federal Reserve should view the deceleration in average hourly earnings growth favorably as it looks for signs of waning support for spending, which would aid in cooling inflation.

Monetary Policy: Inflation and economic activity have slowed broadly per the Fed’s expectation. Data on price pressures between April and June added confidence that inflation would return to the Fed’s target after inflation readings failed to provide such confidence earlier this year.

Labor-market conditions have steadily cooled while inflation resumed a slowdown during the second quarter. That combination has given Fed policymakers who are uneasy about causing unnecessary economic weakness a stronger case for lowering interest rates in the coming months.

The Fed has tried to balance the risk of moving too slowly to reduce rates, which would risk a sharper slowdown in hiring, with the risk of moving too soon, allowing inflation to settle above the Fed’s target.

Should the next two inflation readings remain soft, a September interest rate cut is at play, especially if the labor market slows in a way that either diminishes a potential source of ongoing inflation or risks further unwelcome weakness.

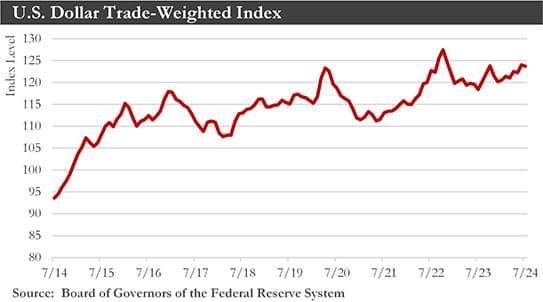

U.S. Dollar: The U.S. dollar could strengthen going into Q3-2024 as the Fed delays easing until September, while central banks such as the European Central Bank, Bank of Canada, and Bank of England cut interest rates earlier than the FOMC.

With several G10 central banks likely to ease monetary policy more gradually than previously expected, only limited foreign currency weakness in the intermediate term is expected.

However, in the longer term, the U.S. dollar should weaken starting in Q4 of this year, with dollar depreciation persisting throughout 2025. Cutting interest rates and slowing U.S. economic growth should place depreciation pressures on the U.S. dollar for an extended period.

China: Following relatively steady activity over the first few months of this year, China's economy has since demonstrated a renewed downturn. Most sentiment and activity indicators have trailed off during the last few months. In Q2-2024, China's economy grew 4.7% year-over-year—a notable slowdown relative to Q1. At first glance, weak domestic consumption has been the primary driver of China's softening economic momentum.

With activity sluggish and price pressures still subdued, the People's Bank of China (PBoC) should ease monetary policy again in the coming months and over the course of 2025. Lower interest rates have been a source of renminbi depreciation; however, policymakers have mounted an effective defense of the currency as the appetite for a weaker currency seems limited. Longer-term, the outlook for the renminbi is encouraging.

Global economy: The global economy should remain resilient this year, with a GDP growth of 3% in 2024. Economic resilience has flowed through to central bank monetary policy as institutions worldwide have turned more cautious when considering rate cuts.

The United Kingdom has gathered economic momentum as the recovery has accelerated. Eurozone trends have weakened modestly; however, recent downtrends in sentiment data have reflected political uncertainty rather than economic reality. Eurozone growth could be sluggish in 2024, although now that elections in France have concluded and a sense of political clarity has been achieved, broader Eurozone recovery momentum could also pick up pace.

Persistent wage growth and services inflation would make the European Central Bank (ECB) wary of proceeding too quickly with additional rate cuts. In that sense, the ECB should initiate two more 25 bps rate cuts by the end of this year. Stable economic activity is likely in the emerging markets.

Outlook: The July data were generally consistent with the view that momentum has gradually faded in the U.S. economy. There were few upside surprises, but in most cases, the positive headline numbers masked signs of moderation percolating beneath the surface. The flat headline reading on retail sales reminded us that consumer spending has gradually lost steam, a trend that will continue.

In addition to higher interest costs, fewer savings, and slower income growth, a softer labor market has become the next challenge for the consumer. Both initial and continuing jobless claims have trended higher in recent months, indicating that the pace of layoffs has risen and that finding a new job has become more difficult. The labor market was loosening up, adding credence to the view that growth should moderate in the second half of the year.

A downshift in the residential housing sector has been another sign that overall growth is easing. Higher rates finally appear to be restricting activity, and single-family starts and permits have both weakened over the past several months. Builders have been scaling back production. Meanwhile, in June, industrial production marked the first two-month string of improvements in overall production since 2021. June's gain was widespread across major industry groups, with manufacturing, mining, and utilities rising steadily. Although the recent improvements have been encouraging, the factory sector has struggled under elevated interest rates.

The message delivered in July was that economic activity, although still holding up, looked to be decelerating. The silver lining has been that financial markets are fully on board with the Federal Reserve initiating a rate-cutting cycle sooner rather than later. The Fed should start with a 25 bps reduction in September, followed by another 25 bps cut in Q4. Less restrictive monetary policy should eventually help foster a more robust pace of growth, but in the meantime, the U.S. economy appears set to slow.

Sources: Bureau of Labor Statistics, Department of Labor, Department of Commerce, Bloomberg, Institute for Supply Management, National Association of Homebuilders, National Association of Realtors, People’s Bank of China, European Union Statistics Agency