Recap: The U.S. economy has continued to lose momentum. Growth has yet to slow to the point that it would concern policymakers, but it could soon if current trends continue. This would influence the Fed's calculations but likely not until it shows up more strongly in the monthly payroll numbers. However, developments in the labor market have been famously lagging indicators, meaning showing up later than other signs when an economic shift would occur. The early signals have begun.

Consumer spending continued to show signs of fading as retail sales barely grew in May following a decline in April. Overall, weak retail sales have been consistent with a U.S. economy losing momentum. Consumers could finally start yielding to the pressures of elevated prices and higher borrowing costs. However, consumer income showed some strength in May; spending was more modest, and most importantly, the core personal consumption inflation index notched its smallest annual gain in more than three years.

Additional business investment slowdown seems likely as higher financing costs have challenged capital expenditure spending. Manufacturing projects have boosted structure spending, but a sharp downshift in new commercial development appears set to drag down overall investment in physical structures.

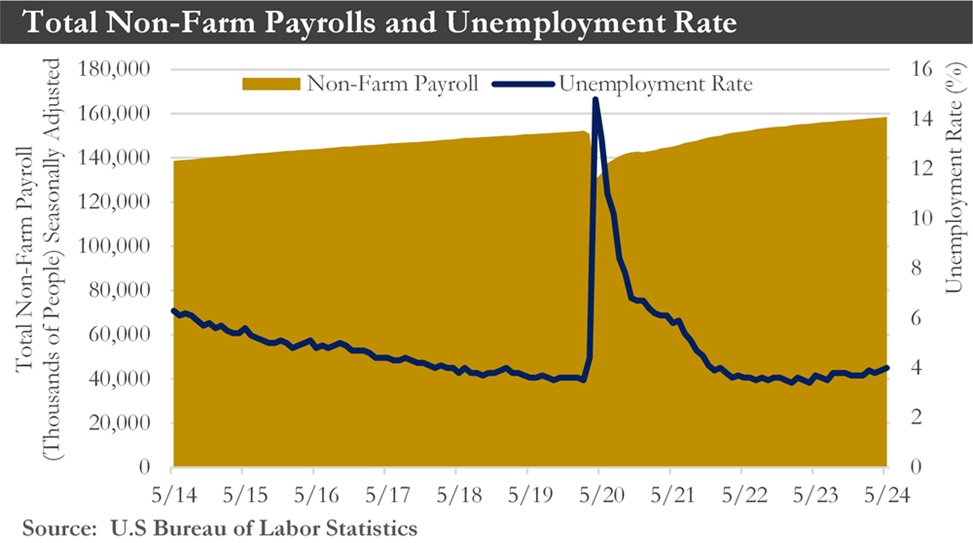

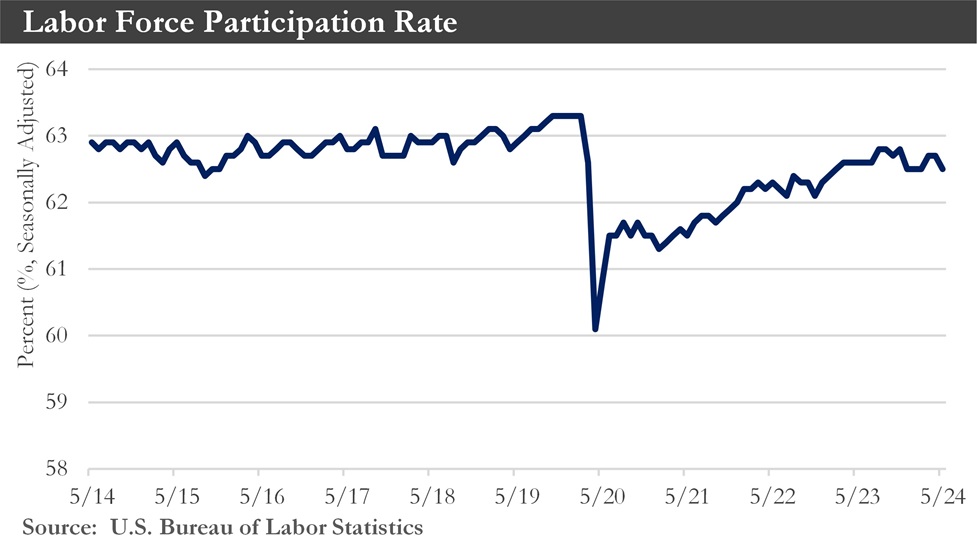

Although strong recently, the labor market has appeared poised for moderation. Payroll growth should average roughly 135,000 per month in the second half of the year, a downshift from the 245,500 averaged so far in 2024. Slower employment growth and improving labor supply should generate a slightly higher unemployment rate, reaching around 4.0% or higher this year.

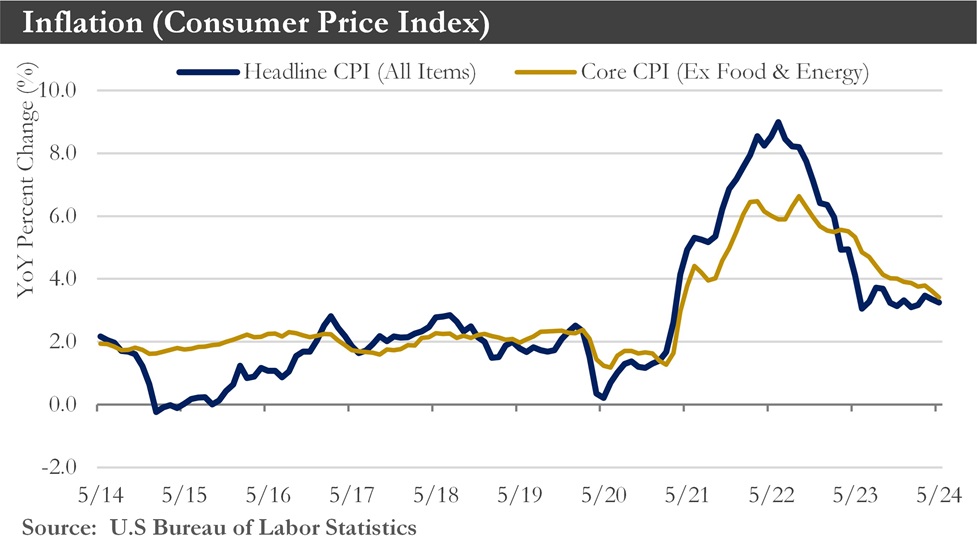

Although concerning, the recent bump in inflation does not appear to be the start of another rapid price run-up, and softer inflation readings have been posted recently. The Fed's preferred inflation gauge, the core personal consumption index, posted at 2.6% in May, down from 2.8% in the prior month.

Inflation: U.S. inflation slowed in May, extending an easing in price increases after a hot start to the year. The consumer-price index, a measure of goods and service costs, rose 3.3% annually last month. Core prices, excluding volatile food and energy items, climbed 3.4% from a year earlier.

Last month's deceleration has further supported the idea that the flare-up in inflationary pressures earlier this year has subsided. The three-month annualized rate of change on core dipped to 3.3% – the slowest growth since December 2023.

The 3-and-6-month inflation trends are likely to cool through the second half of the year and be at a level by late 2024 where policymakers would feel comfortable beginning to dial back the policy rate.

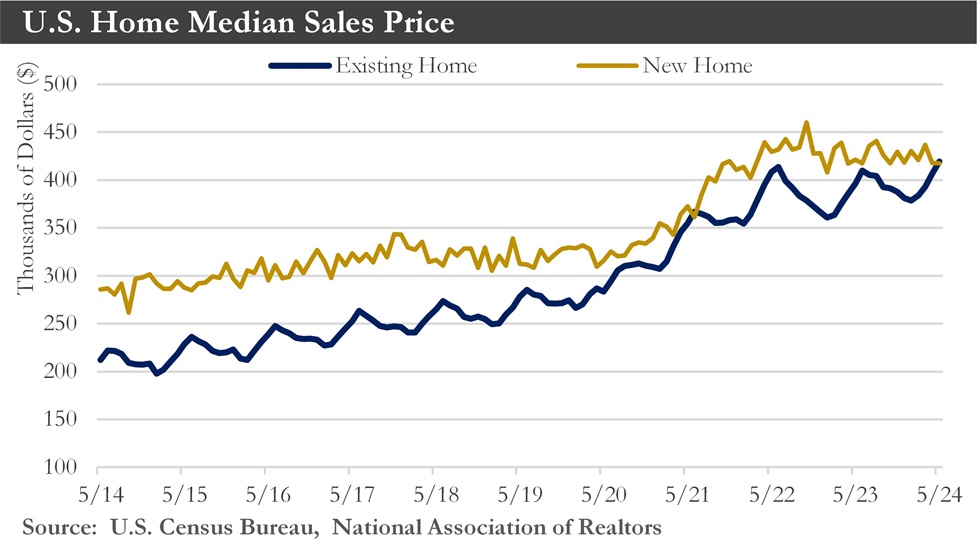

Housing Market: The housing market has continued to be mired in a tangle as elevated mortgage rates and record home prices dissuade prospective buyers and keep potential sellers on the sidelines. Mortgage rates rose recently as sticky inflation in the first quarter prompted a rise in rate expectations. Homebuying broadly retreated in response, giving way to new and existing home sales declines.

Meanwhile, new home sales have notched a sharper-than-anticipated drop over the month. Although builders have been relatively successful in using sales incentives to stabilize demand, the downturn would suggest that some builders may need help to offset the recent leg up in financing costs. Rising resale inventories may be another hurdle weighing on new home demand. That said, plentiful supply should continue to be a tailwind for builders.

With recent softer inflation readings, long-term interest and mortgage rates have been slipping. Will they decline enough to see any meaningful pick-up in sales activity in 2024? Time will tell.

Labor market: Non-farm employment surged by 272,000 in May. Civilian employment plummeted by more than the labor force, pushing the unemployment rate higher by 0.1 percentage points to 4.0% – a 28-month high. Meanwhile, the labor force participation rate dipped by 0.2 percentage points to 62.5%. Average hourly earnings were up 0.4% in May.

While employment growth has continued at a solid pace, there have been ample signs that the heat in the labor market over the past few years has largely been removed. Declining job openings, a falling quit rate, narrowing employment growth, and decelerating wage growth all point to a labor market with better balance. Policymakers could see slower inflation reported over the summer so that they can start cutting rates by the Fall.

Monetary Policy: In its June meeting, the Federal Reserve Open Market Committee (FOMC) maintained the federal funds rate in the 5.25% to 5.50% range and announced it would continue its balance sheet runoff.

The Fed could still cut rates in 2024, but the upturn in inflation over the first few months of 2024 caused the Fed to proceed more cautiously.

The Fed needs more evidence that inflationary pressures have eased. While the trend has improved since April, with May's CPI report substantiating that view, the bar has been raised for the Fed. The odds of a September rate cut are lower than a month ago. The economic growth and inflation profile has yet to convincingly provide the Fed with enough evidence that cuts are warranted.

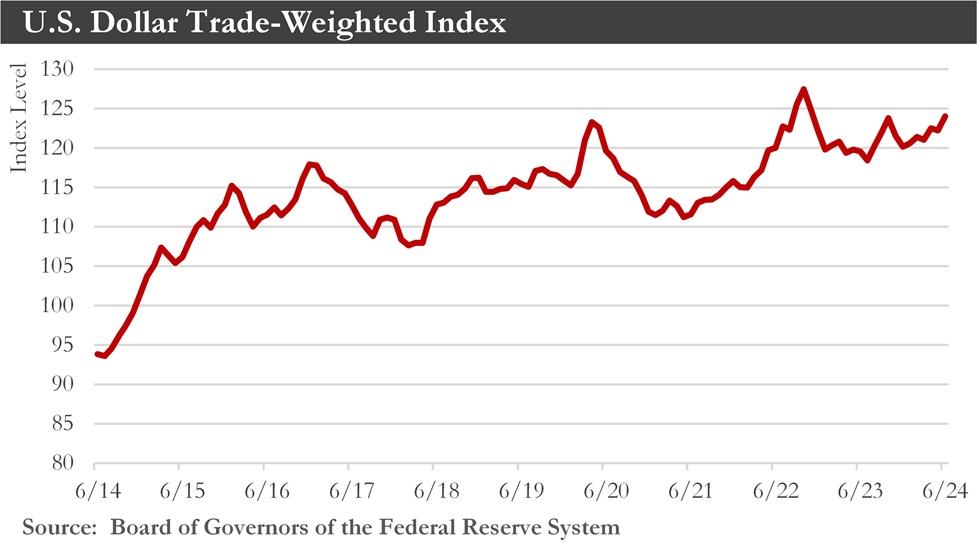

U.S. Dollar: The strength of the U.S. dollar has changed little, and a period of strength should persist through Q3 of this year. The initial rate cut expected from the Fed is happening later than the monetary easing from several other major central banks, including the European Central Bank, Bank of England, and Bank of Canada.

The later Fed easing and, for the time being, reasonably resilient U.S. growth should support the U.S. dollar in the short run. A gradual U.S. dollar deprecation over the longer term should begin in Q4 of this year and continue through 2025, as U.S. growth slows while other major economies gradually recover. As the Federal Reserve joins the trend of global monetary easing later this year, that would contribute to moderate U.S. dollar depreciation.

European Central Bank (ECB): The ECB has joined the growing group of advanced economy central banks that have begun their monetary easing cycles, lowering its Deposit Rate by 25 bps to 3.75%. The improving inflation outlook has been critical to their decision to lower interest rates. The ECB will likely pause in July before cutting rates again in September, October, and December. However, ECB policymakers would prefer to see a return to an overall downward trend in wage growth and domestic inflation to be entirely comfortable with lowering interest rates that much. Thus, the risks have tilted toward lesser easing.

China: China's May economic data have suggested policymakers have much to do to sustain the fragile recovery. Retail sales, a key metric of consumer spending, rose 3.7% in May from a year earlier, compared with 2.3% in April. While the trend has been heading in the right direction, it has remained at a relatively subdued level of growth, below what would be needed to kick-start a significant revival in consumer spending.

Industrial production expanded 5.6% in May compared with a year earlier, down from April's 6.7% increase. Fixed-asset investment growth, of which 40% came from the property and infrastructure sectors, also decelerated in May.

Key to the sluggish economic activity data in May—and China's outlook going forward—has been the crisis in the property market, which has proven problematic for policymakers to address. The property sector has struggled with oversupply and weak buyer sentiment since 2021, when a multi-year housing boom ended. The market has not found a floor, even after Beijing rolled out its most aggressive stimulus measures in mid-May in hopes of restoring confidence.

Outlook: After a better-than-expected year for economic growth in 2023, the U.S. economy should slow to a below-trend pace in 2024 as the impact of higher interest rates weighs on demand. Although the year began with optimism that easier monetary policy would be in the not-too-distant future, the start of the Federal Reserve's rate-cutting cycle has seemingly been delayed by a flare-up in inflation.

While the recent bump in inflation is undoubtedly concerning, the FOMC would still likely reduce the federal funds target rate later this year as price pressures return to a cooling trend. Supply chains should continue functioning more-or-less normally, meaning goods prices should remain contained. Food prices are not accelerating, while lower oil prices point to energy cost disinflation in the months ahead. Service sector prices remain problematic, but more moderate economic growth and a softer labor market should help relieve some of that pressure.

A return to easing inflation in the year's second half still seems probable, allowing the Federal Reserve to initiate a rate-cutting cycle this Fall. At its September meeting, the FOMC may be in a position to lower the federal funds target rate by 25 bps. The Federal Reserve can afford, however, to be patient since economic growth has continued to hold up remarkably well, largely thanks to a resilient pace of consumer spending.

Capital Markets Commentary

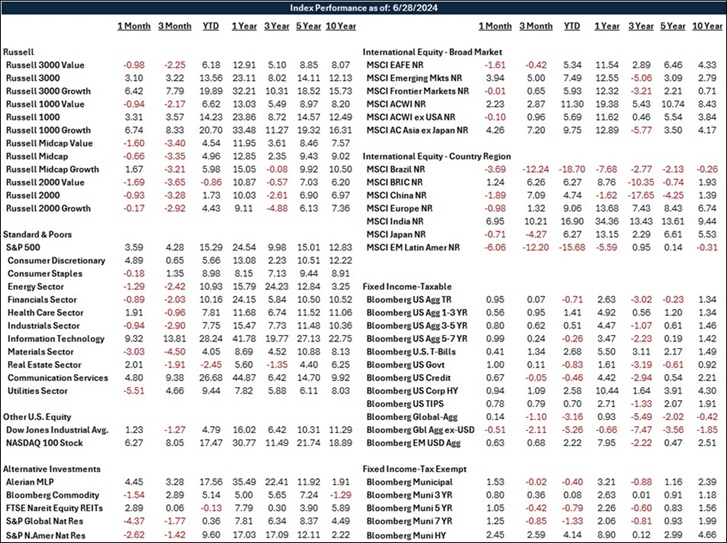

Recap: Stock markets globally posted second quarter returns dominated by U.S. Technology and Communication Services stocks. Led by the often labeled Magnificent 7 (Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla), Technology stocks surged almost 14% while the Communication Services stocks were up over 9%. But for the performance of a handful of companies in these sectors, the broad stock market would have lost ground in 2Q. Bond markets posted largely positive results in Q2 with only corporate credit in the U.S. just about breaking even while international fixed income was underwater; the latter because of the strong U.S dollar and declining rates overseas. U.S. equity performance was unusually bifurcated with what seems like extreme concentration of positive results; almost like a tale of two markets. While many investors expected the Federal Reserve to begin cutting interest rates by now, the Fed appears in no rush to cut rates in the face of inflation that has yet to achieve the kind of decline that gives the Fed the confidence they need to begin changing their interest rate policy.

Large cap U.S. stocks delivered some gains in the second quarter. The gains were concentrated in growth style stocks, however. In a continuation of recent form, growth-style stocks handily outpaced value stocks. While the Russell 1000 Growth Index was up 6.7% the Russell 1000 Value Index was down -2.2%. The broader S&P 500 was up 4.3%, the Russell Mid Cap Index was down -3.4%, while Small-Cap stocks in the Russell 2000 were down -3.3% in Q2.

Bond performance, however, was largely positive in Q2 despite the volatility of interest rates on the benchmark 10-year U.S. Treasury which bounced between 4.3% to 4.7%. The Bloomberg Aggregate Index, representing a broad cross-section of the bond market, posted a 0.1% return for the second quarter. With signals that the Federal Reserve will hold off cutting rates for now, short-term bonds outpaced longer-term maturities. Not surprisingly, corporate bonds with higher credit risk than U.S. Treasuries posted lower returns in this rate environment but barely, down -0.1%. Riskier junk bonds were up 1.1%, while the Bloomberg Global Aggregate Bond Index ex-U.S. bonds was down -2.1%.

Outlook: The outlook for stock returns in the near to intermediate term, despite the strong returns of 2024 year-to-date, remains uncertain given a resolute Federal Reserve in its battle to fight inflation and just a handful of stocks leading the market higher with seemingly stretched valuations. Corporate earnings seem poised to pick up their pace of growth but how long that will last if the economy continues to slow is also uncertain. Expensive valuations are especially true for the Magnificent 7. The NASDAQ 100 Index, about 50% comprised of these stocks, outpaced the S&P 500 by almost 4% for the quarter. At this stage there is scant evidence that stronger performance is beginning to broaden with more favorably priced but slower-growing non-technology and cyclical stocks getting recognized by investors.

The outlook for bonds continues to look rather bright, mainly due to the likelihood that the Fed is closer to the end of its rate hiking cycle, inflation is slowly coming down, and now bonds offer a respectable coupon rate after years of ultra-low interest rates. Over 80% of bonds globally offer coupons of 4% or higher, quite a change after years of ultra-low interest rates. Bond coupon rates finally provide real competition for investment dollars versus stocks for more conservative income-oriented investors, given the more expensive investment profile of stocks.

There continue to be downside risks to the capital markets, which should be kept in mind as 2024 continues to unfold. Political gridlock in Washington, D.C., the war in the Middle East and in Europe to name a few. And the races for the Presidency and Congressional seats that are heating up with conventions just around the corner. Presidential years tend to be positive years for equity returns (though past performance does not guarantee future results).

Also, historically, the Federal Reserve has tended to avoid changing its monetary policy in any meaningful way as elections approach so as not to appear partisan. It is even possible, depending on how inflation data emerges in the months ahead, that there will be no rate cuts this year. And if forces that could negatively impact inflation (like rising oil prices, commodities, wages, or from increased demand from goods and services) slow the decline of inflation or even reverse it, it would be unlikely the Fed could cut rates. Any combination of the above risks could disappoint investors and persuade them to head for the sidelines.

The longer-term view of markets suggests that the tailwinds stock and bond investors enjoyed in recent years, including massive fiscal stimulus and declining and ultra-low interest rates will not resurface soon to smooth over inevitable hard economic times. On top of that, the unusual expansion of stock valuations from extreme investor enthusiasm for stocks over investment themes like artificial intelligence will run its course. These conditions should favor patient astute stock and bond selection.

Disclosures:

Past performance quoted is past performance and is not a guarantee of future results. Portfolio diversification does not guarantee investment returns and does not eliminate the risk of loss. The opinions and estimates put forth constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Securities are not insured by FDIC or any other government agency, are not bank guaranteed, are not deposits or a condition to any banking service or activity, are subject to risk and may lose value, including the possible loss of principal.

Atlantic Union Bank Wealth Management is a division of Atlantic Union Bank that offers asset management, private banking, and trust and estate services. Securities are not insured by the FDIC or any other government agency, are not deposits or obligations of Atlantic Union Bank, are not guaranteed by Atlantic Union Bank or any of its affiliates, and are subject to risks, including the possible loss of principal. Deposit products are provided by Atlantic Union Bank, Member FDIC.