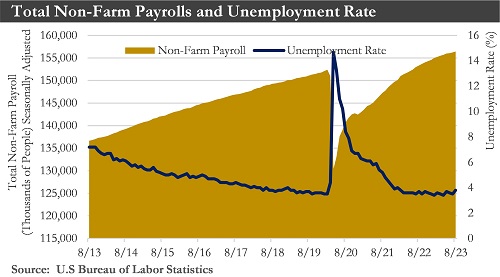

However, employment costs are rising at a rate inconsistent with 2% inflation. To bring inflation back to target, the Fed will need to create some slack in the labor market via sub-trend economic growth, leading to wage moderation and less upward pressure on consumer prices. The Federal Open Market Committee's (FOMC) tightening has likely ended. That said, policy easing is not expected for a while, which will cause the after-inflation fed funds rate to increase in the coming months as inflation recedes further. In other words, there will be a passive tightening of policy.

Fitch became the second major rating agency to lower its evaluation of the U.S. government's creditworthiness. Fitch's rationale was related to growing fiscal deficits in the near-term and medium-term budgetary challenges stemming from aging demographics and a multi-decade erosion of governance. Broader implications are expected to be muted as the U.S. economy continues to have strong fundamentals. However, it comes at a time when credit standards are already tight.

The Institute for Supply Management Purchasing Managers Index data showed a notable divergence between the manufacturing and service sectors, with the former contracting for a ninth consecutive month and the latter expanding for a seventh straight month in July. Employment growth in both parts of the economy slowed last month, but the services sector is still creating jobs as demand remains robust. In contrast, the manufacturing employment subindex hit its lowest level in three years.

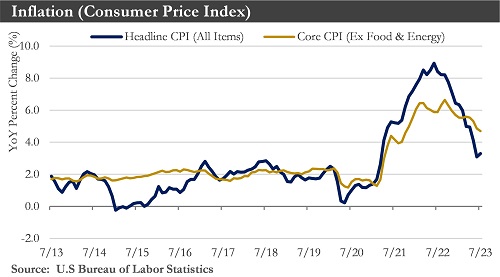

Retail sales surprised to the upside in July, rising 0.7% over the month. If sustained, the renewed strength in retail sales could support the factory sector in the coming months. Manufacturers remain broadly cautious of not overproducing and careful to take on only a little inventory in this tight credit environment. Borrowing costs continue to rise. Higher mortgage rates crimped the housing market for the better part of 2022. Still, home buying demand has found firmer footing this year, especially in the new home market, where builders offer price cuts, rate buy-downs, and other incentives to move on their inventory. The trend improvement in new home sales has put some wind in the sails of residential construction. Permits typically lead housing starts by one to two months, and the recent acceleration suggests that single-family home construction will continue to recover this year. Core inflation in the year's second half should run about 3% annually. This expected improvement relative to the 4.6% pace of core inflation in the first half of this year will likely be enough to where the FOMC believes it could sit and wait for the effects of prior tightening to work through the economy.

In short, activity data show the U.S. economy is expanding at a solid rate. There is still the likelihood that the economy will experience a few quarters of negative GDP growth and declining employment next year. But the probability of a “soft landing” has increased.

Inflation: During July, the headline and core measures of the Consumer Price Index (CPI) rose 0.2%. These monthly gains provided additional evidence that price pressures have continued to recede. Inflation's descent, however, continues to be gradual. On a year-over-year basis, the core CPI was up 4.7% in July. The climbdown in inflation continues to be aided by smoother functioning supply chains and normalizing demand. The downshift in inflation without a material deterioration in economic growth has raised the likelihood of a soft landing.

.jpg)

That said, inflation is still above the Fed's 2% target by most measures, and the path from here is anything but certain. There is more clarity on the trajectory of shelter costs (rents and mortgages), which have been a substantial driver of overall inflation over the past year. The pace of shelter inflation has eased in recent months. In addition, apartment demand has been more modest recently, and the pipeline of new apartment construction continues to run at a near-record pace. Together, these factors point to a further moderation in shelter costs in the near term.

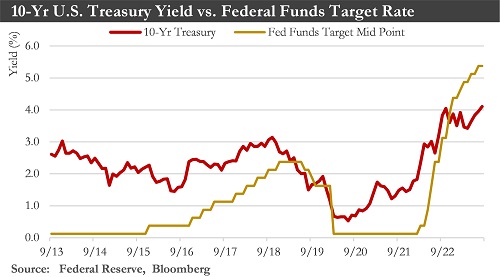

Monetary Policy: With inflation trending favorably and the labor market showing early signs of cooling, the FOMC likely has the reassurance it needs to move to the sidelines and wait for the full effect of past tightening to work its way through the economy. However, with core inflation expected to run higher than 3% through Q1-2024, rate cuts remain a long way out. The FOMC will likely leave the Fed funds policy rate unchanged when they meet in September. However, they are likely to continue to emphasize the importance of incoming data in determining the future path of interest rates as the ultimate form of ‘landing’ for the economy becomes more apparent.

Labor Market: The U.S. labor market is showing fresh signs of easing, with slowly falling job openings adding to figures that illustrate the Federal Reserve is making progress in cooling the economy and lowering inflation. Labor supply and demand continue to come into better balance. Nonfarm payrolls rose by 187,000 in July while payrolls in Juen and July were revised down a combined 110,000. Over the past three months, 150,000 jobs were added monthly on average, down from 238,000 in March through May. The labor force participation rate has risen to a cyclical high of 62.8%. The unemployment rate also rose to 3.8%, the highest in 18 months. Thus far, the labor market has continued to cool enough that underlying inflation pressures are easing but not so much that the economy has tipped into a recession. That said, the weight of the evidence still suggests that the labor market remains too tight to be consistent with 2% inflation, and more softening in the labor market is expected in the months ahead.

U.S. Dollar: The U.S. dollar had an incredible run throughout 2022 as the Federal Reserve embarked on its historic rate hiking cycle to curtail the worst bout of inflation in forty years. With inflation pressures proving more persistent than anticipated, global central banks are poised to continue their rate-hiking campaigns and keep policy rates higher for longer. The cumulative tightening of central banks will slow global economic activity, with the most harmful effects in Europe, where central banks will remain in tightening mode for longer. In this environment of heightened global uncertainty and relative U.S. economic outperformance, flight-

to-safety inflows will likely push the dollar higher. Only once economic uncertainty abates is the dollar likely to see some reversal.

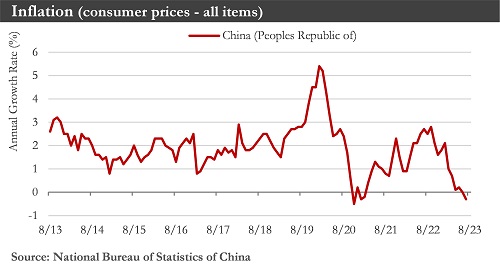

China: Recent data have signaled deepening troubles for China’s economy. The economic recovery in China has been losing momentum because of many problems. First, a drop in exports is accelerating. China’s exports to the rest of the world tumbled in July, offering fresh evidence that drying up Western demand is hurting Beijing’s attempts to rekindle growth. Second, the country’s beleaguered housing market shows new distress signs. Third, youth unemployment has hit record highs.

Most importantly, China is on the brink of falling into deflation, a scenario that could drag the economy into a downward spiral. China’s consumer prices tipped into deflationary territory in July for the first time in two years. Chinese consumer prices fell 0.3% in July compared with a year earlier. This deflation could be transitory, however. July's negative consumer inflation result was mainly driven by a drop in food prices from a year earlier when extreme weather pushed up food prices. So-called core inflation rose to 0.8% in July, the highest level since January, from 0.4% in June after volatile food and energy prices have been removed.

The danger is that if the expectation of falling prices becomes entrenched, it could further sap demand, exacerbate debt burdens, and even lock the economy into a trap that will be hard to escape using the stimulus measures Chinese policymakers have traditionally turned to. China’s central bank has trimmed interest rates several times this year. Still, fiscal, and monetary policymakers haven't launched any larger-scale stimulus measures, partly because of constraints such as elevated debt levels. China’s central bank is expected to lower interest rates further in the coming months, though such moves alone may not dispel deflationary pressures.

The Eurozone Economy: Rising borrowing costs and stagnating Chinese demand for European goods could pave the way for another miserable economic winter for the eurozone this year. These headwinds, including the continuing war in Ukraine and stubbornly high inflation, mean the region will likely keep underperforming the U.S. for now. After briefly shrinking at the end of last year, the currency area’s economy returned to growth in the three months through June. The combined gross domestic product of the 20 countries that use the euro grew at an annualized rate of 1.1% in the second quarter. That modest pickup mirrored an acceleration in U.S. economic growth during the same period and contrasted with a slowdown in China. Figures from individual countries indicate that consumer spending held up better than during the winter months when high energy bills left households with less to spend on other goods and services. Businesses are also under pressure. Business demand for new loans is at a record low, indicating that investment spending is set to weaken.

The silver lining for the eurozone is that the weakness of China’s rebound has limited its demand for liquefied natural gas and kept costs for the currency area’s energy suppliers down as they build up reserves ahead of the second winter without access to historically cheap Russian supplies. The combination of weak growth and falling inflation reduces the likelihood that the ECB will raise its key interest rate for the 10th time when policymakers meet in September.

Outlook: No additional rate hikes are expected from the FOMC, with the first-rate cuts occurring possibly in early to mid-2024 as the U.S. economy falls into a mild recession and core inflation is much closer to 2%. Monetary tightening policies are expected to continue until the end of Q1-2024. After that, the FOMC is expected to keep the size of its balance sheet flat as it enters a rate-cutting cycle. With the end of the tightening process nearly complete and a recession on the horizon, a steeper yield curve and lower Treasury yields are expected later this year and into 2024.

The global economy is expected to grow 2.7% in 2023 before decelerating slightly in 2024. There have been some shifts below the surface, most notably in China. Activity has struggled to maintain the momentum after China's economy reopened for their COVID lockdown policy, with the services PMI falling further in July. With Chinese authorities taking a cautious approach toward monetary easing and no signs of large-scale fiscal stimulus yet, in 2023, China’s GDP growth should be around 5.2%.

As the growth outlook stabilizes and inflation trends gradually improve, the central banks of the major developed economies should be near the end of their monetary tightening cycles. With the U.S. economy slipping into a mild recession next year and the Federal Reserve potentially turning to monetary easing next year, a change in trend for the U.S. dollar in 2024 would not be surprising. That said, if the balance of risks continues to shift toward a shallower or no U.S. recession and the need for less aggressive Fed rate cuts, the U.S. dollar's decline might be less pronounced than anticipated.

Source: Department of Labor, Department of Commerce, Bloomberg, European Central Bank

Disclosures:

Past performance quoted is past performance and is not a guarantee of future results. Portfolio diversification does not guarantee investment returns and does not eliminate the risk of loss. The opinions and estimates put forth constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Securities are not insured by FDIC or any other government agency, are not bank guaranteed, are not deposits or a condition to any banking service or activity, are subject to risk and may lose value, including the possible loss of principal.

Atlantic Union Bank Wealth Management is a division of Atlantic Union Bank that offers asset management, private banking, and trust and estate services. Securities are not insured by the FDIC or any other government agency, are not deposits or obligations of Atlantic Union Bank, are not guaranteed by Atlantic Union Bank or any of its affiliates, and are subject to risks, including the possible loss of principal. Deposit products are provided by Atlantic Union Bank, Member FDIC.