Recap: Economic growth in the United States has continued to run at a sturdy pace. After expanding solidly during the year's first half, real GDP has shaped up, rising at a 3.0% annualized pace in the second half. The effects of higher interest rates have been readily apparent, with nonresidential structures and residential investment setting up to remain drags on headline economic growth. However, most other major segments have continued to perform relatively well. A strong rate of consumer spending should continue to be the driving force behind overall growth. At the same time, business investment in equipment and intellectual property products has strengthened in recent months.

Looking ahead, some near-term moderation in real GDP growth would appear possible as tight monetary policy's lagged effects further affect households and businesses. That noted, several encouraging developments have tilted the growth outlook to be more optimistic.

This more constructive view has been partly derived from new data showing that households have a stronger financial position than first thought. A firmer labor market outlook has been another factor likely to fortify spending. Weaker demand for workers could result in more moderate employment growth and slightly higher unemployment rates in the coming months.

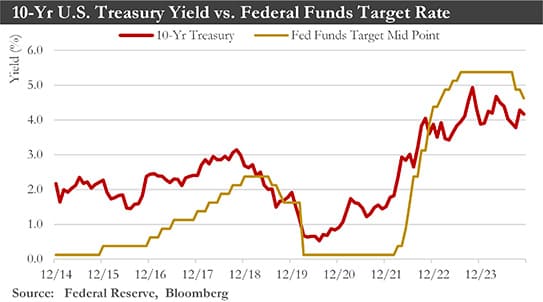

Improved labor market prospects have arrived amid additional signs that the cooling trend in inflation has remained intact. Another positive development is that the Federal Reserve has started to ease monetary policy. Lower rates should promote more robust consumer spending, unshackle business investment, and energize real GDP growth.

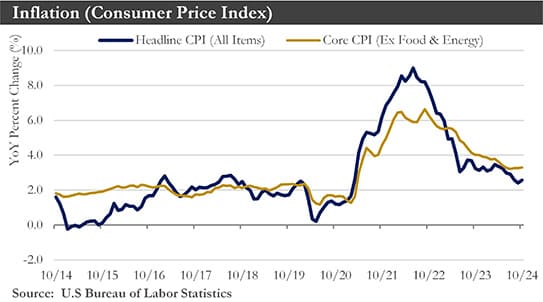

Inflation: The consumer Price Index (CPI) rose 0.2% in October from September. Looking back on one year, CPI ticked up to 2.6% (from 2.4% in September). Core prices rose 0.3% monthly, matching the two prior months' gains. The twelve-month change held steady at 3.3%.

Progress on the inflation front has slowed recently as services inflation looks increasingly sticky. At the same time, much of the disinflationary pressure from falling manufactured goods prices has moved into the rearview mirror. This inflationary pressure would suggest that returning inflation to the Fed's 2% target will likely occur gradually.

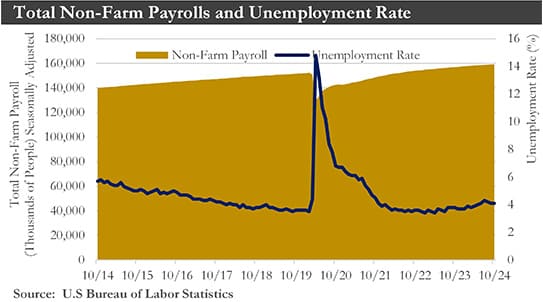

Labor Market: Job growth slowed sharply in October, with workers sidelined by hurricane effects and impacted by the continuing Boeing strike. The economy added a seasonally adjusted 12,000 jobs in October versus a September gain of 223,000. The unemployment rate stayed steady at 4.1%. Average hourly earnings were up 4% from a year earlier.

Hurricanes Helene and Milton put thousands of people out of work across the Southeast, while the Boeing strike took more people off work. The sharp drop in job growth could indicate that disruptions played a much more significant role than anticipated. Still, the downturn should be temporary and not impact on the more important dynamics of the market. Unemployment remained low, and wages continued to rise. This month's data has continued to point to a decelerating labor market that has not necessarily deteriorated.

Monetary Policy: In November, The Fed’s Federal Open Market Committee (FOMC) lowered the target range for the federal funds rate by 25 bps to 4.50%-4.75%. The Fed should reduce this interest rate by another 25 bps at its final 2024 meeting in mid-December, but the outlook for 2025 has become unsettled. To the extent the incoming administration's tariff and income tax policies would raise inflation, it could cause a slower reduction in interest rates, potentially closer to bottoming out around only 4% next year. The FOMC would wait until policies are fully formed and their effects better understood before acting.

U.S. Dollar: The contrast between more gradual easing from the Federal Reserve and several foreign central banks that would be likely to lower interest rates at more regular intervals has contributed to a stronger outlook for the U.S. dollar. The U.S. dollar should appreciate through most of 2025. These dollar gains could accelerate through late 2025 and into 2026 as U.S. economic growth picks up and the pace of Federal Reserve monetary easing slows further and eventually ends.

Holiday Sales: A modest holiday sales season should occur in a year when sustained consumer spending propelled growth and helped the economy avoid recession. Holiday sales would rise 3.5% in November and December compared to last year, below the long-run average.

Consumers have spent more throughout the year instead of waiting for Christmas. Therefore, a soft finish to retail spending in 2024 need not set off major concerns about the sustainability of spending in 2025.

Eurozone: The Eurozone’s economy grew 0.4% in the third quarter, accelerating from 0.2% in the April-June period, a boost to hopes that the bloc could be set for a soft landing from the surge in inflation that followed Russia’s invasion of Ukraine. The pickup in growth would ease the worries that a long period of high interest rates has stalled the currency area’s recovery and would ensure policymakers at the European Central Bank (ECB) that rapid cuts to its key interest rate should not be needed.

Indeed, key concerns have remained surrounding the outlook for the eurozone, particularly in its moribund manufacturing sector. Rising barriers to trade, a shortage of skilled labor, and high borrowing costs have not helped.

While the growth data have put to rest questions of whether the eurozone is in recession, there has been an apparent continued weakness in investment, suggesting that worries about the outlook have yet to be wholly misplaced.

The ECB has responded to those concerns about growth by accelerating its interest rate cuts. However, the ECB would need to take bigger steps and reduce rates to the point where they could stimulate the economy.

China: China's economy showed signs of improving last month after Beijing's blitz of growth-friendly policies. Authorities would still need to do more to keep the momentum going, as Donald Trump's re-election could raise the specter of a new trade war with the U.S.

Chinese industrial production slowed slightly in October, and the real estate sector remained in a deep slump. However, retail sales increased, and investment in buildings, equipment, and other fixed assets remained steady.

China's economy should be back on track to meet the government's goal of around 5% growth this year after authorities cut interest rates in September and pumped up the stock market with financial support pledges.

However, with President-elect Trump returning to the White House, China's economic outlook has darkened. On the campaign trail, Trump said he would raise tariffs on all Chinese imports into the U.S. to 60%, a move aimed at narrowing the U.S.'s yawning trade deficit. Such a move, if enacted, would hammer China's economy, especially if other countries followed suit with tariffs and other duties to shield their domestic industries from Chinese goods redirected from the U.S.

Weakening exports, a bright spot for China's economy, would pressure Beijing to fire up domestic spending with further interest rate cuts and more government borrowing to finance extra spending. In particular, Chinese authorities would need to find ways to end a drawn-out property crunch and spur a durable revival in consumption.

In short, the boost to growth from easing measures so far should prove short-lived unless there is substantial fiscal stimulus next year.

Outlook: Q3 was another solid quarter for the U.S. economy. Beyond the housing market, few signs of elevated interest rates have exerted any meaningful drags on domestic activity. That said, economic growth should end the year on a softer note, as a further cooling in the labor market has led to some moderation in consumer spending. Growth should also see some distortions stemming from Hurricanes Helene and Milton, which have likely displaced some near-term activity across parts of the Southeast. However, the clean-up and rebuilding efforts following a natural disaster tend to offset any lost output.

The U.S. economy could be poised to achieve a soft landing. This outcome should allow the FOMC to gradually reduce its policy rate over the next year and potentially return closer to its long-run neutral rate of 3% by Q4-2025.

President-elect Donald Trump has inherited a relatively benign outlook. There has been much uncertainty about what policy proposals from the campaign trail will be prioritized and if/when they are ultimately implemented. The size and scope of these policy initiatives remain uncertain and up for debate.

Sources: U.S. Bureau of Labor Statistics, Department of Commerce, Bloomberg, Eurostat