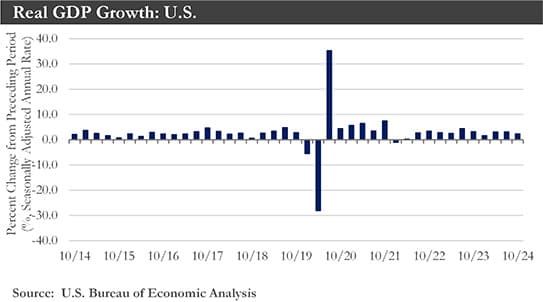

Recap: Growth slowed but remained resilient at the end of 2024, leaving the U.S. economy on solid footing heading into a new year. For the year as a whole, GDP increased 2.5 percent in 2024. Robust consumer spending, underpinned by low unemployment and steady wage growth, helped keep the economy on track despite high interest rates, stubborn inflation, and political turmoil at home and abroad.

But the economy entered the new year, facing a new set of challenges. The start to President Trump's second term — including sweeping changes to immigration policy, a spending freeze that was announced and then rescinded, and steep tariffs that could take effect soon — has increased uncertainty for households and businesses. New proposals on trade and immigration, in particular, could add to uncertainty on inflation and economic growth.

Still, the economy has entered 2025 with significant momentum, led by consumer spending, which grew at a 4.2 percent annual rate in the fourth quarter. The housing market, too, showed signs of life at the end of the year, as a drop in mortgage rates spurred construction activity. Residential investment rose after two straight quarterly declines.

There have also been pockets of weakness. In the fourth quarter, businesses invested less in new buildings and equipment, and exports fell. The rebound in the housing market could prove short-lived: Mortgage rates have risen in recent months, and the market for existing homes has remained frozen. The strong spending numbers have partly resulted from consumers moving up purchases to get ahead of tariffs.

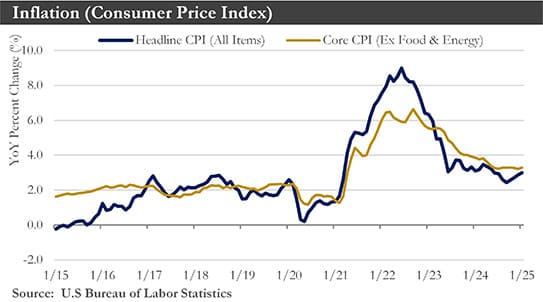

The ratcheting up of trade tensions has been particularly challenging for policymakers, as the Fed's fight to return price stability has hit a wall. The January CPI reading showed headline inflation rising at its fastest monthly pace in nearly a year and a half, while core inflation's gain was the largest since March 2024.

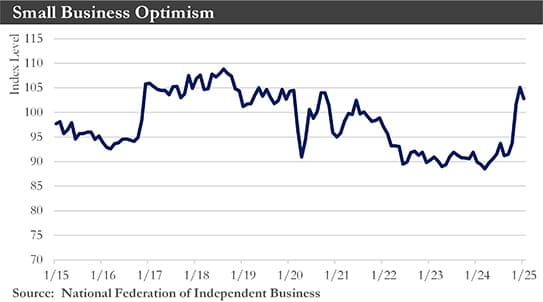

A set of other inflation indicators have provided additional evidence that price pressures are still percolating. The headline and core Producer Price Index (PPI) rose in January. The increase in the PPI would suggest that business input prices are still climbing. Moreover, the NFIB Small Business Optimism Index revealed that, even though businesses have been more enthusiastic about the economy's prospects post-election, inflation could still be a challenge.

Elsewhere, several other indicators of economic activity have wobbled at the start of 2025. Industrial production rose solidly in January; however, the gain was due to a jump in utilities production, likely a result of harsh winter weather. In the meantime, an unexpectedly sharp drop in retail sales could suggest that consumers have tightened their belts to start the year. Total retail sales declined 0.9% during January, a worse outcome than the small drop that was widely anticipated.

The New Administration: President Trump's plan to raise tariffs on Canada, Mexico, and China has rattled markets. Some businesses have begun seeing signs that deportations could affect their workforce. More than 70,000 federal employees could resign, and others could rethink their futures under pressure from the new administration. At the same time, President Trump's pro-business, pro-fossil fuel agenda has excited many businesses that have made multibillion-dollar investment announcements.

The end goal would be an economy with a smaller role for imports, immigrants, and the federal government and a bigger role for private investment. But the execution has generated intense uncertainty among business owners, workers, and trade partners that could dampen growth, at least temporarily.

Inflation: Consumer prices rose more briskly than expected in January, extending a recent pattern of price increases at the start of the year that would strengthen the case for the Federal Reserve to extend a pause in interest rate cuts.

Consumer prices in January rose 3% from a year earlier. Core prices rose 3.3% over the year and 0.4% over the month. Core inflation rose at its fastest pace in nearly a year amid a further uptick in goods prices and ongoing stickiness in services inflation.

Price pressures have persisted at a time of extreme uncertainty about the outlook for the economy just weeks into President Trump's second term in the White House. Tariffs, deportations, tax cuts, and deregulation could have an economic impact, but the final policy mix would determine whether policymakers pay more attention to the risk of resurgent inflation or to an unexpected slowdown in growth.

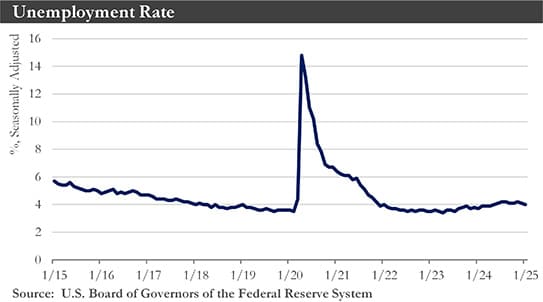

Labor Market: The pace of hiring slowed in January as wildfires and snowstorms suppressed some industries and as the Federal Reserve signaled a pause in its course of interest rate cuts, creating a headwind to growth. The U.S. economy added 143,00 jobs in January, and the unemployment rate edged down to 4%. Sectors, including healthcare and retail, added jobs. Employment in mining and oil and gas extraction declined.

The job market has cooled from its red-hot streak that began during the pandemic but has remained strong. Job hiring and job-quitting have both slowed, but layoffs have remained at longtime lows. Few people have been laid off, but it has become increasingly difficult for those out of work to get a job.

The unemployment rate dipped to an eight-month low, while wage growth has shown more staying power. Average hourly earnings rose 4.1% over the year — well above the inflation rate. Impressive productivity growth over the past year would mean such wage increases could be sustained without increasing prices.

The new Administration’s policies could affect the labor market. The President has promised to cut immigration and launch the largest deportation operation in U.S. history, which could curtail labor force growth. An immigration slowdown could start to affect payroll growth soon.

Tariffs have been another wild card. President Trump has already imposed new import tariffs on Chinese goods and threatened new tariffs on products from Canada, Mexico, and the European Union. Such levies could restrain trade, economic growth, and labor markets.

Small Businesses: The NFIB's Small Business Optimism Index fell 2.3 points to 102.8 in January. Seven out of ten subcomponents deteriorated during the month, with the remaining categories roughly unchanged.

Small business confidence retraced some of its post-election gains in January but has remained roughly ten points above its October level. Expectations for more accommodative fiscal and regulatory policy have bolstered optimism about the economy in the months ahead. Still, many subcomponents that track current and planned activity have seen trivial improvement over the past three months. Severe weather in January may have played a role in this trend, but an elevated degree of uncertainty has also likely weighed on small businesses.

Firms have faced many uncertainties currently prevailing, related to monetary, fiscal, and trade policies, which interact simultaneously with firm expectations. With monetary policy on hold for the near future, fiscal policy grinding slowly through Congress, and trade policy front and center, uncertainty would remain a constraint on business confidence over the coming months.

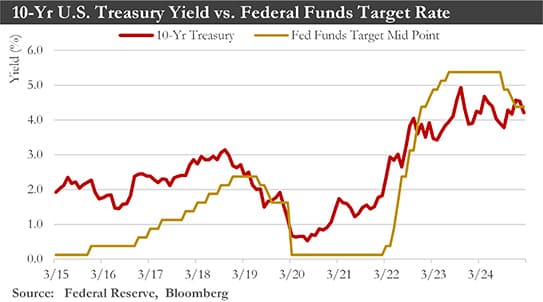

Monetary Policy: Fed officials have clarified that they are in no hurry to adjust their current monetary policy stance. With inflation progress stalling in recent months and heightened uncertainties about how far the new Administration would go on tariffs, the Fed could remain more cautious on rate cuts and hold the policy rate steady until sometime this summer. Expectations would be for at least one cut in September or December of this year, but the risks have been skewed toward no cuts if the inflation data do not cool further in the months ahead.

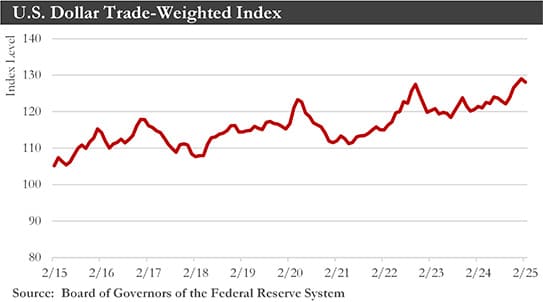

U.S. Dollar: Economic and policy trends should remain supportive of the U.S. dollar for an extended period, and the trade-weighted U.S. dollar to strengthen through all of 2025 and into 2026. Regarding U.S. dollar performance against the G10 currencies, economic factors could be the most critical drivers of U.S. dollar strength. Relatively resilient activity, higher inflation from increased tariffs, and more cautious Federal Reserve easing would be among the key trends expected from the United States this year. Through the first half of 2025, the pace of U.S. economic growth should outpace other G7 economies while risks to the longer-term international growth outlook would tilt to the downside, potentially widening U.S. economic outperformance. Economic outperformance should lead to the Fed being more cautious while other G10 central banks turn more dovish. A Federal Reserve on hold through the first half of 2025 should reinforce gains in the U.S. dollar while other G10 central banks could lower interest rates steadily.

Eurozone: Eurozone inflation increased in January, with the outlook clouded by the threat of higher barriers to global trade flows. European Central Bank policymakers have anticipated easing inflation through 2025, allowing them to lower interest rates to spur the euro area's struggling economy.

Economic growth was flat in the final quarter of last year, as Germany's economy contracted for a second year in a row. The ECB cut its key rate to 2.75% from 3 percent and signaled more cuts to come as inflation fell toward its target. Another rate cut should occur at its next meeting in March and perhaps through the summer and beyond.

Europe’s export-oriented economy has been highly exposed to trade tariffs emanating from the U.S., the continent’s biggest export destination. Many businesses could pause investment decisions until President Trump's policies become clearer, weighing on activity. Meanwhile, political uncertainty has intensified inside significant nations such as France and Germany and rising global bond yields have pushed up borrowing costs in Europe. In addition, the stability of the multi-generational NATO Alliance could be questioned.

Given this backdrop, downside risks have seemed more likely to this moderate Eurozone 2025 GDP growth forecast of 1.0%.

China: In China, the economy ended 2024 on a respectable note as Q4 GDP rose 1.6% quarter-over-quarter. With upward revisions to prior quarters, Q4 growth increased to 5.4% year-over-year. Several factors contributed to the strong showing, including reductions to benchmark interest rates and the Reserve Requirement Ratio, government property support measures, and modest fiscal stimulus measures. However, the key driver of China's economy in Q4—and for most of last year—was a robust export sector.

Going forward, this reliance on exports to drive growth could be a problem for China. This would stem not just from tariffs disrupting exports but also because China, at a broader level, would be replaced in the global supply chain. Without a strong domestic consumption engine for growth, China's economy could remain at risk the longer it depends on exports. Even if authorities accommodated some weakening in the renminbi to maintain trade competitiveness, lower interest rates, and ease liquidity conditions, these policy interventions would not fully offset the drag on growth from softening external demand. Given these challenges, China's GDP growth would slow to 4.5% in 2025, down from 5% in 2024.

Outlook: While the exact path of U.S. tariff policy remains uncertain for now, the outlook remains for a global GDP growth slowdown this year. Higher U.S. tariffs will go into effect soon. At the same time, overall restrictive monetary policy across the advanced economies should also be a restraining factor for economic activity. A degree of U.S. economic outperformance seems likely to persist, with the impact of higher tariffs contributing to sluggish growth trends from key advanced and emerging economies.

Real U.S. GDP, which rose at an annualized rate of 2.3% in Q4-2024, should strengthen to about 3% in the current quarter. Some of this near-term pickup in growth would reflect an inventory-build ahead of the coming tariffs. Later in the year real GDP growth will likely downshift starting in the second quarter as the price-boosting effects of the tariffs negatively affect growth in real income, thereby weighing on growth in real consumer spending. Some acceleration in economic activity in 2026 could come, in part, from a looser regulatory environment that should be conducive to stronger growth in business fixed investment spending. Congress will also legislate tax cuts later this year that would total roughly $1 trillion over the next 10 years. The one-off boost to real disposable income should lead to a re-acceleration in consumer spending next year.

An increasingly divergent outlook for global monetary policy is expected during 2025. The Federal Reserve is expected to lower interest rates cautiously, while the ECB may follow suit with relatively aggressive easing. China's central bank is also expected to ease monetary policy further.

Sources: Bloomberg, Peoples Bank of China, European Central Bank, U.S. Department of Labor, U.S. Department of Commerce, National Federation of Independent Business