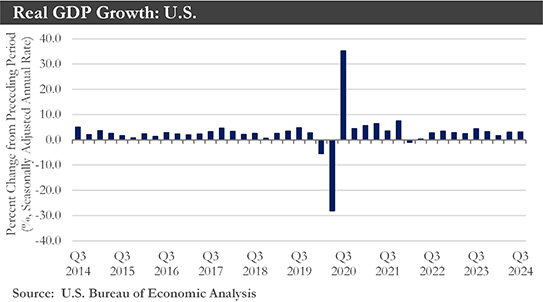

Recap: Final third-quarter real GDP growth was upgraded to 3.1% from 2.8%. Economic growth remained solid, expanding well above trend, with underlying domestic demand accounting for last quarter's gain. Consumers have borne the scars of inflation, as evidenced by increased debt delinquency rates, diminished savings, and selective spending habits. In the aggregate, however, the financial position of households has been relatively strong, and there have been few signs that consumers are pulling back on spending meaningfully.

Looking ahead, some near-term moderation in real GDP growth has appeared as the lagged effects of tight monetary policy have further affected households and businesses. Several encouraging developments have been noted to paint a more optimistic outlook for growth.

New data reveals households are in a stronger financial position than first thought, generating a more constructive view.

Another factor likely to fortify spending is a firmer labor market outlook. Weaker demand for workers should result in more moderate employment growth and a slightly higher unemployment rate in the coming months.

Improved labor market prospects have arrived amid additional signs that the cooling trend in inflation has remained intact.

Another positive development has been the Federal Reserve starting to ease monetary policy. Lower interest rates should promote stronger consumer spending, unshackle business investment, and energize real GDP growth.

The U.S. economy ended 2024 on solid footing, thanks to an expanding, resilient consumer and generally healthy business investment. The road ahead could face obstacles. New economic policies due to the election could arrive in 2025 and beyond. While the full extent of changes to the regulatory environment, tax policy, tariffs, and immigration remained unknown, the proposals outlined throughout the campaign could imply higher inflation and weaker growth in the near term. Further out, the growth-enhancing effects of lower taxes and a more friendly business environment should lead to an accelerated pace of economic activity.

Incoming Trump Administration: President-elect Trump's campaign agenda was focused on four key pillars: tariffs, taxes, immigration, and deregulation. The most significant and immediate economic policy change would be higher broad-based tariffs. Although the full impact of Trump’s tariff threats is uncertain (i.e., 60% on China and 10% on all other trade partners), it could create a mild “stagflationary” shock for the U.S. economy.

Immigration would be another area where Trump has more latitude in acting independently and taking early action. Through executive orders, the next president could significantly increase border enforcement, reinstate a "remain in Mexico" policy, and declare "illegal immigration" as a national emergency, which would unlock funds for border wall construction. These executive orders could result in over two million fewer individuals entering the U.S. by the end of Trump's term. For 2025 alone, it could shave a modest 0.1 percentage points from growth.

On the tax side, the first order of business would be to extend the expiring provisions of the 2017 Tax Cuts & Jobs Act. While Mr. Trump campaigned on several additional tax reductions, these would require Congress to pass legislation. Although the Republicans control the Senate and House, a thin majority in the latter would mean near-unanimity among GOP members. Further tax cuts could prove challenging amidst a ballooning deficit.

Lastly, the high potential for deregulation, particularly across industries like energy and finance, should offer some upside risk to economic growth. However, it would be difficult to quantify until new policies have been announced once the new Administration takes office.

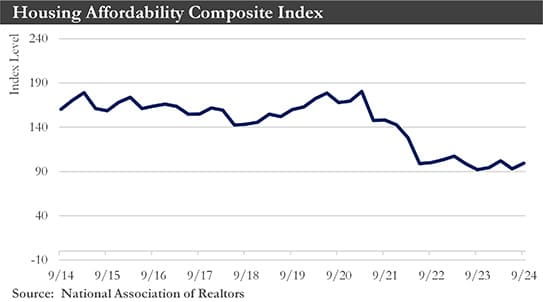

Housing: Significantly eroded affordability has been at the heart of the weak housing recovery for several years. Over the past month, the 30-year fixed mortgage rate has increased by nearly 100 bps to 7%. Unsurprisingly, home sales have remained more than 30% below their early-2022 pre-Fed tightening levels. Over the near term, sales would likely tick a bit lower and stage only a modest rebound in the first half of 2025.

Another constraint on home sales has been limited supply. In the face of a multi-decade high in mortgage rates, many "would-be" sellers would face a near doubling in their next mortgage by selling their existing property. This lock-in effect has constrained inventories and supported upward pressure on prices.

No meaningful change in this situation will likely occur until after the Federal Reserve cuts another 75 bps in interest rates and owners have been enticed to list their homes. Should interest rates stay persistently higher, it could impact the timing and trajectory of a housing recovery. Even after the Fed has normalized its policy rate, mortgage rates would likely settle at nearly 200 bps above 2019 levels. With home prices still nearly 50% higher than in 2019, affordability would not return to pre-pandemic levels.

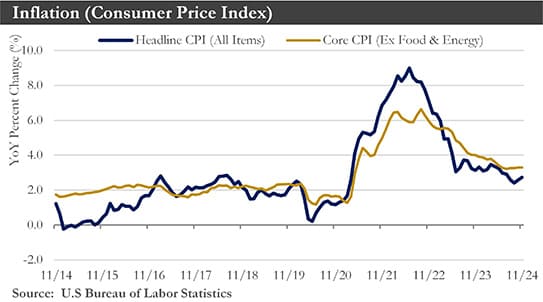

Inflation: Consumer prices rose 0.3% in November, the highest reading since April. It pushed the last 12-month change up to 2.7%. A 0.6% increase in gas prices at the pump contributed to the monthly CPI increase. The Core CPI prices advanced 0.3% for a fourth consecutive month.

In 2024, inflation continued to slow, although more gradually than many had hoped. Furthermore, supply and demand in the labor market have come into balance and would not likely be a meaningful source of inflationary pressure in 2025. The FOMC should continue to reduce the federal funds rate next year to move monetary policy to a less restrictive position but at a gradual and measured pace.

Labor Market: U.S. job growth surged in November after being severely constrained by hurricanes and strikes in October. These surges have not necessarily signaled a material shift in labor market conditions that continued to ease steadily and gave the Federal Reserve leeway to cut interest rates in December. Nonfarm payrolls increased by 227,000 jobs last month after an upwardly revised 36,000 increase in October.

Unemployment remained low, and wages continued to rise. Other data out this month have continued to point to a slowing but not necessarily deteriorating labor market.

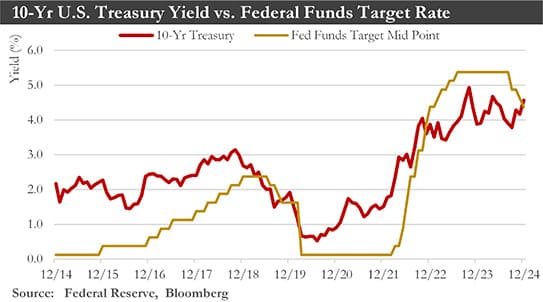

Monetary Policy: As widely expected, the Federal Open Market Committee (FOMC) reduced its target range for the federal funds rate by 25 bps. The latest cut, approved by 11 of 12 Fed voters, would lower the Fed’s benchmark federal funds rate to a range between 4.25% and 4.5%, a two-year low. The Fed reduced rates at its two previous meetings amid signs the labor market might be weakening.

The December FOMC meeting suggested that barring some dramatic, unexpected development, the Committee would keep rates on hold at its next meeting in January. The FOMC could continue to ease its policy next year, although at a slower pace than over the past few months. The federal funds rate should drop to a target range of 3.50% to 3.75% by the end of 2025.

U.S. Dollar: A strong dollar throughout 2025 should occur as Mr. Trump begins his second term. The contrast between more gradual easing from the Federal Reserve and foreign central banks would lower interest rates faster, contributing to a stronger outlook for the U.S. dollar. The trend of the U.S. dollar should be for appreciation through most of 2025. The pace of those dollar gains should accelerate through late 2025 and into 2026 as U.S. economic growth picks up and the pace of Federal Reserve monetary easing slows further and eventually ends.

The Global Economy: The Eurozone’s economy grew 0.4% in the third quarter, accelerating from 0.2% in the April-June period, a boost to hopes that the bloc has been set for a soft landing from the surge in inflation that followed Russia’s invasion of Ukraine. The pickup in growth would ease worries that a long period of high interest rates has stalled the currency area's recovery. It would reassure the European Central Bank policymakers that rapid cuts to its key interest rate should not be needed. The ECB responded to concerns about growth by accelerating its interest rate cuts. The ECB would need to move in more significant steps and reduce rates to the point where it would stimulate the economy.

China's economy showed signs of improving in the last two months after Beijing's blitz of growth-friendly policies. However, authorities would need to do more to keep the momentum going now that Donald Trump's re-election has raised the specter of a new trade war with the U.S. Chinese industrial production slowed slightly in October, and the real-estate sector remained in a deep slump. However, retail sales increased, and investment in buildings, equipment, and other fixed assets remained steady.

China's economy has gotten back on track to meet the government's goal of around 5% growth this year after authorities cut interest rates in September and pumped up the stock market with pledges of financial support. But President-elect Trump’s threat to raise tariffs on all Chinese imports into the U.S. to 60% or higher would pummel China’s economy, especially if other countries followed suit with tariffs and other duties to shield their domestic industries from Chinese goods redirected from the U.S. Weakening exports, long a bright spot for China’s economy, would pile pressure on Beijing to fire up domestic spending with further interest rate cuts and more government borrowing to finance extra spending.

Outlook: Slower economic growth should occur in 2025 due to the likelihood of higher new tariffs. Tariffs imposed during President Trump's previous Administration were met with retaliation from U.S. trading partners, a combination that could depress exports, real incomes, and consumer spending. The new tariffs would go into effect in the second half of this year when economic momentum has downshifted.

Growth would appear likely to pick up in 2026 once the initial impacts of the tariffs have faded and the full slate of Republican policy changes have gone into effect. Specifically, the economy would receive a boost from a lighter regulatory touch and the prospect of additional modest tax relief for households.

Absent tariffs, the jobs market has already trended softer. Payroll growth has been highly concentrated among industries, and labor force growth has slowed considerably. Although the unemployment rate has remained low, there has been an upward movement in the number of permanent job losers and the median duration of unemployment, trends that have historically predated recessions.

Meanwhile, disinflation has been proceeding at a frustratingly slow pace. The Fed's preferred inflation gauge has remained unchanged for the past six months amid a slowdown in goods’ deflation and still-firm price pressures in the services sector.

Incoming inflation data warrants further Fed easing, but at a slower pace. Although new tariffs would trigger a temporary reacceleration in inflation, the FOMC could disregard the inflationary bump and more heavily prioritize the tariff-driven hit to GDP and job growth. The FOMC would switch to every-other-meeting cuts in March, June, and September 2025, leaving the federal funds rate within a target range of 3.50%-3.75% by year-end.

Capital Markets Commentary

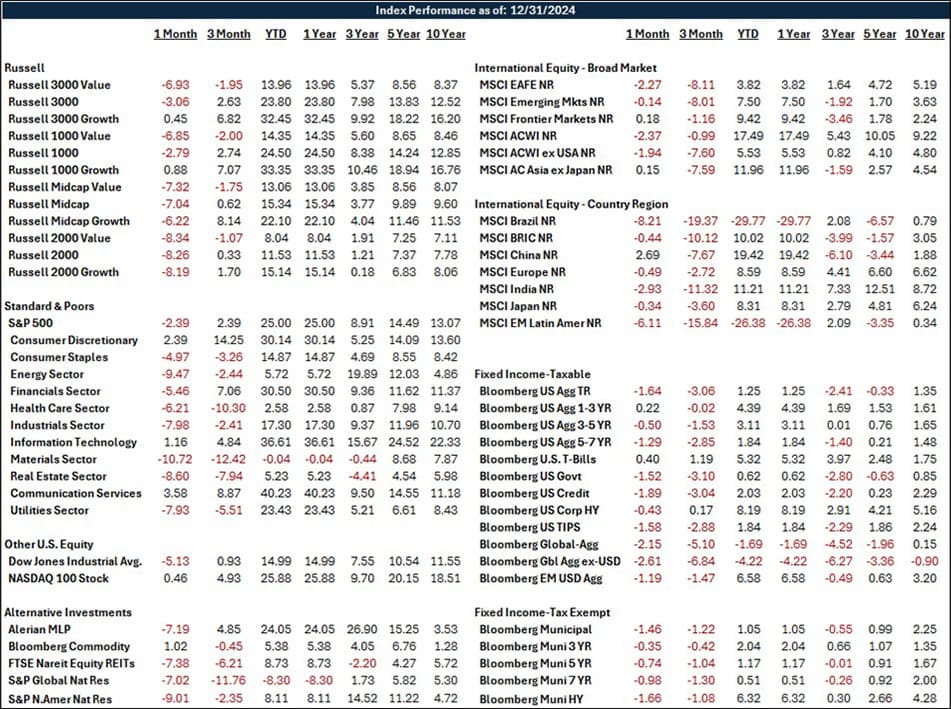

Recap: Stock market results in the fourth quarter were mixed globally. Once again, the U.S. market was led by Growth-style economic sectors like Consumer Discretionary (+14.3%), Communication Services (+8.9%), and Information Technology (+4.8%) stocks. The Financial sector also posted strong results (+7.1%), likely due to the prospect of a lighter regulatory touch by the next Administration. Several economic sectors in the market failed to produce a positive return for the quarter, including Health care, Materials, Real Estate, Staples, Energy, and Industrial stocks. Bond markets were mainly in the red as prospects of higher inflation and long-term interest rates in 2025 hit bond prices—short-term U.S. Treasury bills, however, posted positive results in Q4 and for all of 2024.

Large-cap U.S. stocks delivered uneven results in the fourth quarter. Value stocks lost ground in Q4, while Growth stocks regained their market-leading luster. The Russell 1000 Value Index was down -2.0% (but up 14.4% in 2024), while the Russell 1000 Growth Index was up 7.1% (and 33.4% for the year). The broader S&P 500 was up 2.4% (and 25.0% for the year), the Russell Mid Cap Index was up 0.6% (and 15.3% in 2024), while Small-Cap stocks of the Russell 2000 were up 0.3% in Q4 (and 11.5% for 2024).

Bond market performance was largely negative in Q4 as investors began reacting to prospects of higher inflation from the next Administration’s proposed policies (from tariffs and deportations) and fewer interest rate cuts than anticipated by the Federal Reserve. The yield curve continued to normalize after years of more extreme inversion. The benchmark 10-year U.S. Treasury ended the fourth quarter at around 4.5%, up from 3.7% at the end of last quarter, while the 90-day U.S. Treasury Bill ended the quarter down to 4.3% from 4.6%. The Bloomberg Aggregate Index, representing a broad cross-section of the bond market, posted a -3.1% return for the fourth quarter and a 1.3% return for 2024. Corporate bonds also posted a -3.1% quarterly return (and 2.0% for the full year). Riskier junk bonds were up 0.2% in Q4 (and 8.2% for the full year), while the Bloomberg Global Aggregate Bond Index ex-U.S. bonds were down -6.8% in Q4 (and -4.2% for all of 2024) as the U.S. dollar strengthened.

Outlook: The outlook for stock returns in the near to intermediate term remains uncertain despite the strong returns of 2024. Corporate earnings for 2025 for the S&P 500 are forecast to grow by double digits, but expensive stock valuations make strong stock market advances from these price levels suspect. The general expectation is that the economy will weaken over the next few quarters before recent and future rate cuts filter through to the economy and pick back up in late 2025 and into 2026. Whether market leading performance remains concentrated in a handful of technology names or broadens to a larger set of names remains an open question.

The outlook for bonds as 2024 ends appears somewhat mixed, given the market’s reaction to the next Administration's proposed policies. This response has resulted in a yield curve that is finally normalizing, with short-term rates coming down but long-term rates going up. This is a welcome sign after years of yield curve inversion (with short-term rates higher than long-term rates), which often signals an oncoming recession.

There have continued to be risks to the capital markets, which should be kept in mind as 2025 gets underway. These include the market's possible reactions to the next Administration's new fiscal, political, and geopolitical policies, stock market concentration, and elevated stock valuations. The margin for errors in judgment becomes smaller, and the market's reaction to deviations from what is expected to unfold when stock valuations are high can be pronounced.

Sources: Institute for Supply Management, Department of Labor, Department of Commerce, Bloomberg, National Federation of Independent Business, Federal Reserve, European Commission, National Association of Realtors, U.S. Department of the Census, U.S. Bureau of Economic Analysis, Peoples Bank of China